. . . Is a Multi-Faceted Threat.

China

From ZH:

“A massive heatwave has covered large swaths of China, including Shanghai, Southwest China’s Sichuan Province, East China’s Jiangsu, and Zhejiang provinces, affecting nearly one billion people. “

“The prolonged heatwaves have threatened crops and people’s lives and pushed China’s power usage to record-breaking levels.”

Developing Nations

From OilPrice.com:

-

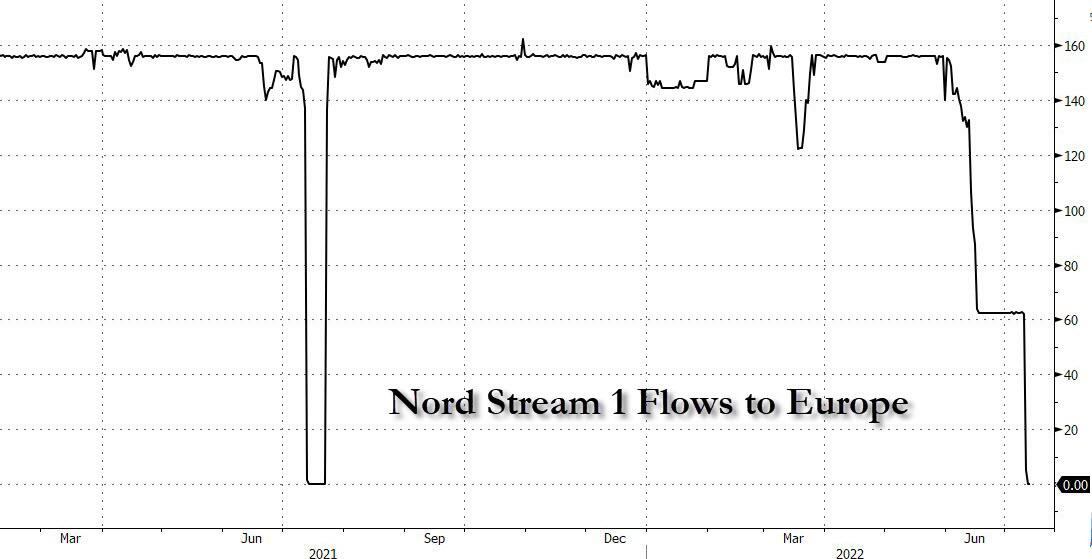

Driven by fears that Russia may cut supply to Europe, the EU imported more LNG from the U.S. than pipeline gas from Russia for the first time ever.

-

This insatiable thirst for natural gas has driven prices so high that developing nations can no longer afford the vital commodity.

Germany

From ZH:

“Energy inflation is out of control in Germany as Russian natural gas supplies plunge as maintenance work begins on the Nord Stream 1 pipeline. Russia has been throttling Europe’s energy supplies since late 2021, and new concerns mount supplies could be halted after the scheduled end of the maintenance work later this month. One official has already warned if energy prices continue to soar, social unrest risks will flourish.”

Deutsche Bank “the largest European bank now predicts that a growing number of German households will be using firewood for heating! Maybe allowing a petulant Scandinavian teenager to set the country’s energy policy was not the brightest idea after all.”

Meanwhile . . .

“German energy giant and distressed nat gas utility Uniper, which is among the companies most exposed to Russian natural gas, has started using gas it was storing for the winter after Russia cut deliveries to Europe, increasing pressure on Berlin as the German energy giant needs to be rescued ‘in a few days.’”

Texas

From ZH:

“For the second time this week, Texas’ power grid operator took emergency action and asked customers to conserve power Wednesday afternoon to avoid rolling blackouts as a heatwave strained power supplies.

“The Electric Reliability Council of Texas (ERCOT) sent customers notices three hours before 1400 local time to reduce power instead of the 18-hour notice for Monday.

“ERCOT blamed Wednesday’s conservation appeal on record high electric demand and the lack of wind and solar power as a relentless heatwave scorched the state.”

France

From Summit News:

“Despite claiming that ‘France has little dependence on Russian gas,’ President Macron announced that public lighting would be turned off at night to save energy.“

AND THIS IS ONLY THE TIP OF THE ICEBERG.