The skinny:

The skinny:

WHY ARE WE MAINSTREAMING THE MARGINAL?

WHAT’S NEXT? CRITICAL DRAG QUEEN THEORY? CDQT?

I WONDER IF THEY HAVE DRAG STORY HOUR IN KIEV?

FROM THE EPOCH TIMES:

New York State, City Paid $200,000 for Drag Queens Reading to Kids at Public Schools, Records Show

From the piece:

“New York City and state combined have paid drag performers more than $200,000 for appearances in New York City public schools since 2018, according to a report.

“Drag Story Hour NYC, an organization previously known as Drag Queen Story Hour NYC, has received $50,000 from the state’s Council on the Arts, as well as $157,000 from New York City’s departments of Education, Cultural Affairs, Youth and Community Development, and Transportation, according to records obtained by the New York Post.”

And this:

“The books used during the story hours typically focus on homosexuality and concepts such as “gender fluidity.” Two of the popular books, “The Hips on the Drag Queen Go Swish, Swish, Swish” and “If You’re a Drag Queen and You Know It,” are authored by a founder of Drag Story Hour and feature classic children’s rhymes rewritten in a way that celebrates the drag lifestyle.

DRAG NURSERY RHYMES FOR KIDS?

REALLY?

Has the next Boudin been targeted?

From CBS Philly:

“Pennsylvania House Republicans have seen enough of the chaos and lawlessness in Philadelphia and have moved to impeach Philadelphia District Attorney Larry Krasner . . . .

“Reps. Josh Kail, Torren Ecker, and Tim O’Neal are leading the charge to start the hearings, citing Philadelphia’s “unchecked crime and violence” as the reason . . . .

“The Reps. are ‘circulating a co-sponsorship memo for supporters of Articles of Impeachment and believe it will receive bipartisan support,’ the CBS report says.”

MORE OF THIS, PLEASE.

ALVIN BRAGG UP NEXT?

It’s white liberals — BRAINWASHED PURVEYORS OF WHITE GUILT AND WHITE PRIVILEGE — who voted to RETAIN BOUDIN. Minorites wanted him OUT.

From Susan Crabtree via RealClearPolitics.com:

“Precinct-by-precinct voting maps show minority voters backing the recall in much higher numbers than college-educated, affluent white progressives, with very few exceptions. It’s not difficult to understand why, California political analysts across the spectrum tell RealClearPolitics.

Minority communities suffer more when crimes rates are soaring than insulated wealthier neighborhoods with more protections and money for security.

“While we are fewer in number [than in the city’s past], we saw more African Americans resist the narrative that you have to reject this recall, it’s racist, it’s not progressive, it’s about conservatism, and they’re trying to dupe you,” Andrea Shorter, spokeswoman for Safer SF Without Boudin, the largest Boudin recall group, told RCP.

“We’re looking around, and a lot of the bodies that are stacking up, whether it’s from fentanyl or from violent assaults from folks who should not have been on our streets…are people of color.”

Moving along:

While Boudin, a former public defender, has blamed billionaire conservatives for funding the effort to toss him from office, voting patterns tell a different story. Boudin lost nearly every heavily minority neighborhood in the city, except Mission District, which has historically served as the center of the Hispanic community but has been gentrified with the dot-com boom and young urban professionals moving into the area.

Let’s hope Boudin is merely the first. We don’t need DISTRICT ATTORNEYS behaving like PUBLIC DEFENDERS and/or SOCIAL WORKERS.

Enough of this NOBLESSE OBLIGE hypocrisy.

And here’s WHY it’s here:

What to do about this?

GOOD LUCK TO ALL. WHAT’S COMING WILL BE EXTREMLY DISRUPTIVE.

OR DO I MEAN DESTRUCTIVE?

From another version of that tweet:

We are being mentally rewired by the technologies of social networking. It’s an involuntary process. It has happened before, here’s what happened when the printing press rewired our brains (see below).

From ZH based on a a post by DB’s George Saravelos:

“The more global inflation picks up, the more the BoJ prints. But the more easing accelerates, the higher the need to press hard on the brake when the (inflation) cliff approaches and the more dangerous it becomes. As a result, we will soon enter a phase where dramatic and unpredictable non-linearities in Japanese financial markets would kick in, according to the DB strategist, who also notes that “if it becomes obvious to the market that the clearing level of JGB yields is above the BoJ’s 25 basis point target, what is the incentive to hold bonds any more?”

“This leave us with a few exploding questions:

Finally, what happens if and when the yen careens off the fiat cliff, and domestic holders of yen-denominated savings flee into either dollars or cryptos? We will find out very soon.“

I WOULD SUGGEST THAT FUNDAMENTAL NON-LINEARITIES HAVE BEEN APPARENT IN JAPANESE SOCIETY AS A WHOLE FOR OVER THIRTY YEARS.

JAPAN HAS BECOME A SIMULATION SOCIETY UNTETHERED TO ANY HONEST MEANS OF VALUATION.

THEY ARE NOW ON THE BRINK OF LOSING CONTROL OF THEIR FINANCIAL SYSTEM. WHENEVER THAT HAPPENS, A COUNTRY CAN NEITHER PRODUCE NOR TRADE THINGS.

THE ONLY OUTCOME WORSE WOULD BE A LACK OF FOOD, WATER, ENERGY, SHELTER AND MEDICINE.

BUT STAY TUNED. THAT’S COMING NEXT.

. . . Against Boycotting Fossil Fuel Energy Companies.

From The Epoch Times:

“Six banks have been warned by the West Virginia State Treasury that they may be in violation of a new law preventing the state from doing business with financial institutions boycotting energy companies.”

“In January of this year, West Virginia divested from BlackRock, the world’s largest asset manager.

“BlackRock CEO Larry Fink has been outspoken in pressuring corporate leaders to commit to investment goals that will undermine reliable energy sources like coal, natural gas and oil under the guise of helping the planet, but at the same time he’s pouring billions in new capital into China, turning a blind eye to abhorrent human rights violations, genocide and that country’s role in creating the COVID-19 global pandemic,” Moore said in a January 17 press release explaining the decision.”

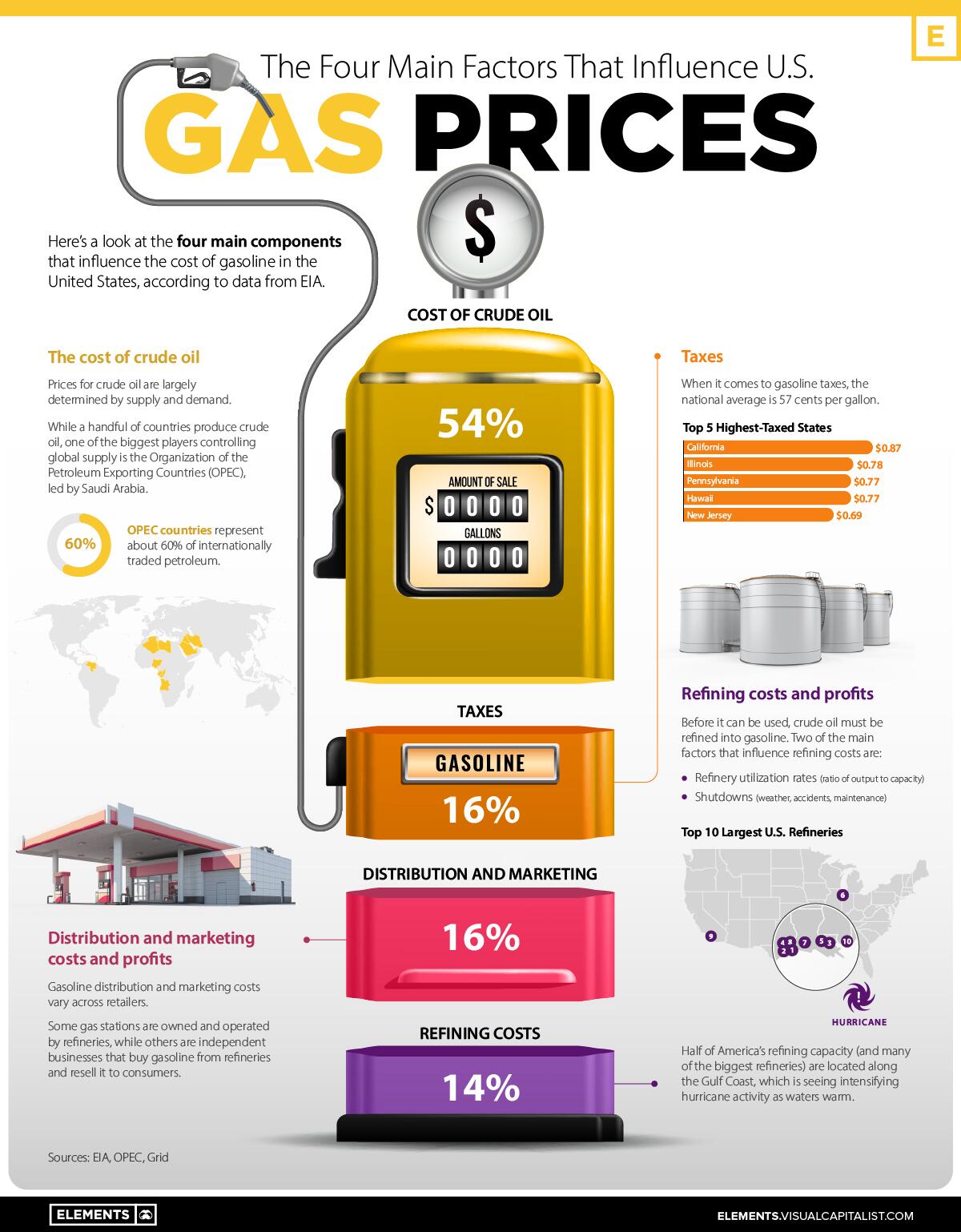

HOW CAN SOMEONE AS INTELLIGENT AS LARRY FINK A) PRETEND WE STILL DON’T NEED MASSIVE AMOUNTS OF FOSSIL FUEL-SOURCED ENERGY; B) IGNORE THE NEGATIVE ECONOMIC EFFECTS OF DISALLOWING FOSSIL FUEL EXPLORATION, PRODUCTION, PROCESSING AND TRANSPORTATION ON ONE OF THE ECONOMY’S KEY SECTORS, INCLUDING THOSE EMPLOYED BY IT; AND C) KEEP POURING MILLIONS OF INVESTMENT FUNDS INTO CHINA WHICH HAS NO INTENTION OF REDUCING CARBON EMISSIONS BASED ON ESG LIMITS OR TIMETABLES?

THIS IS ASS-BACKWARDS REASONING — IF NOT OUTRIGHT HYPOCRISY — CORRUPTED BY WOKE VIRTUE SIGNALING.

As for those OTHER banks in West Virginia, I hope they’re kicked out and disallowed from doing business there.

FIRST THINGS FIRST, ALREADY.