Here comes the ULTIMATE LIBERTARIAN DREAM in its latest ITERATION: A BITCOIN BASED WHOLLY DECENTRALIZED, PEER-TO-PERR WEB.

That’s right. NO GUB’MINT OR OUTSIDE PRIVATE SECTOR INTERFERENCE of any kind.

At least, SO GOES THE CREDO.

From “NAMCIOS” via BitcoinMagazine.com.

“Web5 leverages Bitcoin, the decentralized monetary network, and a plethora of sound computer science technologies to create a new ecosystem of decentralized identities, data storage and applications in which the users are in control of their personal information.”

“TBD’s Web5 is made up of software components and services such as decentralized identifiers (DIDs), decentralized web node (DWNs), self-sovereign identity service (SSIS) and a self-sovereign identity software development kit (ssi-sdk).”

Decentralized Identifiers (DIDs)

“A DID is essentially a globally unique persistent identifier that doesn’t require a centralized registration authority and is often generated and registered cryptographically. It consists of a unique uniform resource identifier (URI) string that serves as an ID with additional public key infrastructure (PKI) metadata describing the cryptographic keys and other fundamental PKI values linked to a unique, user-controlled, self-sovereign identifier in a target system such as the Bitcoin blockchain.”

Decentralized Web Node (DWN)

A “DWN is a mechanism for data storage and message transmission that participants can leverage to locate public or private data linked to a given DID. It enables the interaction between different entities that need to verify the identity of each other in order to transfer information to one another.

“Decentralized Web Nodes are a mesh-like datastore construction that enable an entity to operate multiple nodes that sync to the same state across one another, enabling the owning entity to secure, manage, and transact their data with others without reliance on location or provider-specific infrastructure, interfaces, or routing mechanisms,” per the specification . . . “

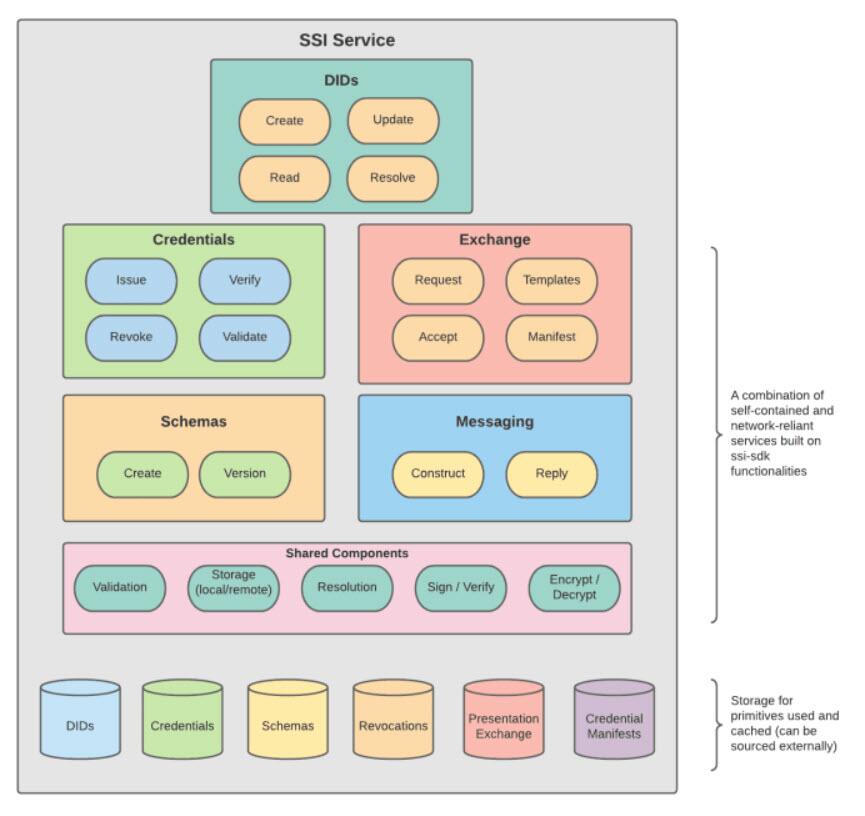

Self-Sovereign Identity Service (SSIS)

“The SSIS interacts with the standards around verifiable credentials, credential revocations, requesting credentials, exchanging credentials, data schemas for credentials and other verifiable data, messaging using DWN and usage of DIDs.

“The SSIS facilitates everything related to DIDs and verifiable credentials.”

Self-Service Identity Disk

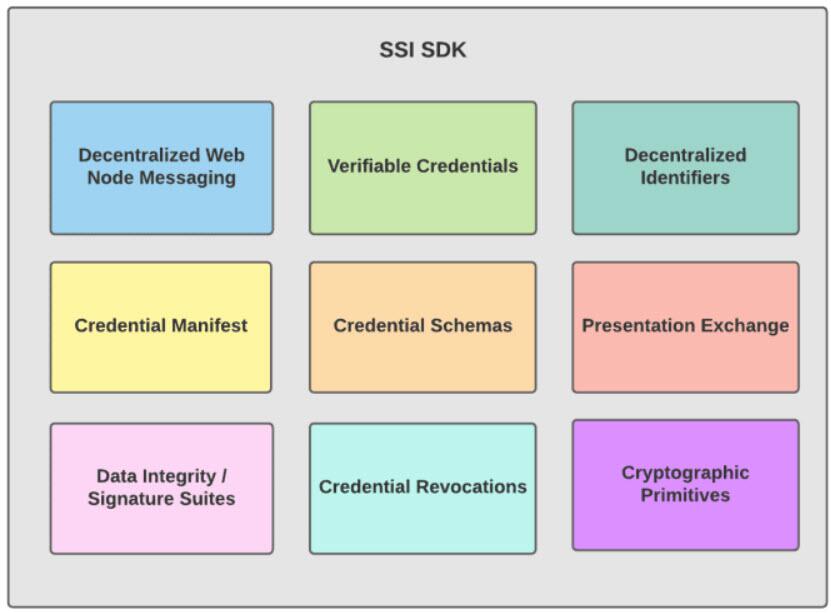

“The ssi-sdk encapsulates standards related to self-sovereign identity.”

Its purpose is “to provide flexible functionality based on a set of standards-based primitives for building decentralized identity applications in a modular manner: with limited dependencies between components,” per its webpage.”

While I have little doubt that Jack Dorsey & friends can develop this technology, I have as LITTLE CONFIDENCE that in the current INFORMATION RICH yet POLITICALLY VOLATILE environment, they can do it on a completely DECENTRALIZED, REGULATORY-FREE basis.

Information today is as VALUABLE as money and just as much a CURRENCY in terms of both VALUE EXCHANGE AND STORAGE.

Just as I don’t expect that SOVEREIGN STATES will ever recognize cryptocurrencies as MONEY, i.e. LEGAL TENDER, I don’t see them allowing the development of a USER-CONTROLLED-ONLY web. It’s simply NOT IN THEIR INTEREST to allow THAT MUCH INFORMATION FLOW to “EVADE” THEIR PURVIEW.

After all, governments are in the business of EXERCISING CONTROL. How can they do that WITHOUT A HAND ON THE SCALES of all that transpires on the web. Plus, one mustn’t forget the various SKIMMING/PERSONAL AGGRANDIZEMENT OPPORTUNITIES that “regulatory” activity provides. In other words, POWER’S SPOILS. Do we think that’s GOING AWAY?

Dream on, libertarians, dream on . . .