One has to wonder why it’s all been GOOD NEWS.

Not RAINBOWS AND UNICORNS, exactly . . . yet all these reports of RUSSIAN INCOMPETENCE.

But now this:

WE’LL SEE WHERE IT GOES FROM HERE.

One has to wonder why it’s all been GOOD NEWS.

Not RAINBOWS AND UNICORNS, exactly . . . yet all these reports of RUSSIAN INCOMPETENCE.

But now this:

WE’LL SEE WHERE IT GOES FROM HERE.

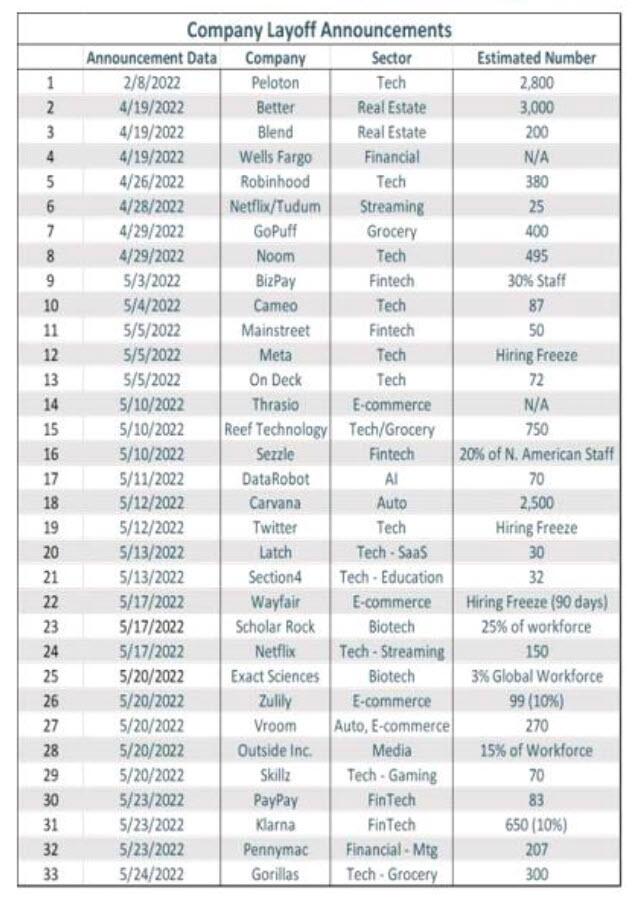

Also known as LAYOFFS.

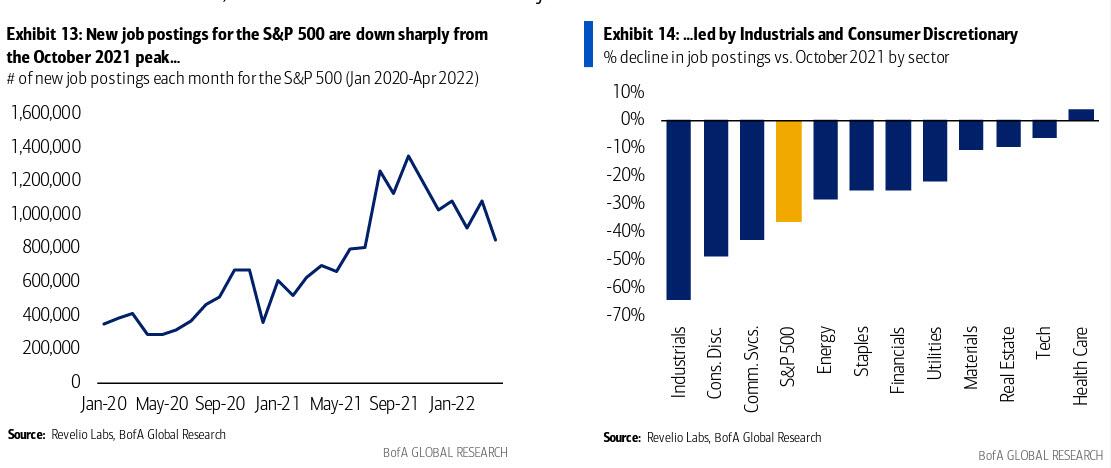

And talk about MOMENTUM PLAYS:

“Commenting on the surge in layoffs, Piper Sandler’s chief economist Nancy Lazar says that ‘post-covid rightsizing means that lots more layoffs are coming’ and adds that ‘many companies overhired and overpaid during the Covid crisis.’ Lazar also points out the obvious, that ‘the stay-at-home bubble was a bubble, and not a ‘new paradigm’ of goods consumption’ which means that ‘a right-sizing cycle is coming, with weaker growth in jobs and wages.'”

Here are the stunning implications according to Piper Sandler:

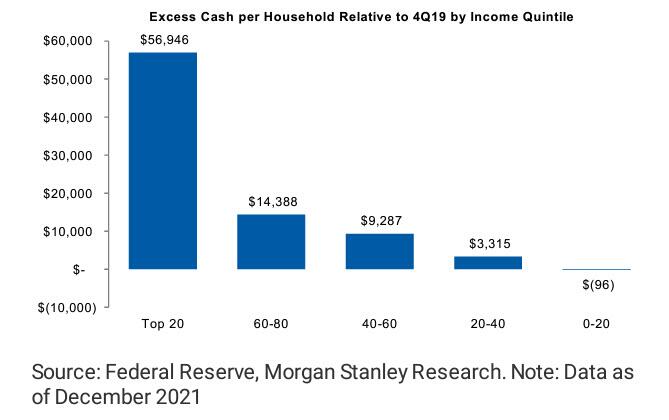

“While the above implications are startling for the US economy as a whole, they are especially bad for America’s poorest quintile which, according to Morgan Stanley calculations, now have less “excess cash” than they did pre-covid.”

“As for the Fed, well with the Citi US Eco surprise index already crashing . . .

. . . one can only imagine where it will go not if but when we get a negative payrolls print in one of the coming months, and what that will do to the Fed’s hiking plans.”

HE WHO LIVES BY INFLATION DIES BY INFLATION.

OR . . .

PAY ME NOW OR PAY ME LATER.

REGARDLESS, LATER LOOKS A LOT LIKE NOW.

Someone had to call out BARE-ASS Powell.

“If the US Federal Reserve wishes to avoid a return to stagflation, it must recognize the huge gulf between the level of real interest rates under former Fed Chair Paul Volcker and the current incumbent. It is delusional to think that today’s wildly accommodative monetary policy can solve the worst inflation problem in a generation.”

Thank God, there are a few REALISTS like Roach left.

And if it means TANKING EQUITIES, so be it. MUCH of their “worth” is simply a fiction.

Here’s the full piece:

. . . or New York, L.A., Philadelphia, Milwaukee or Baltimore

Oh, and I’m leaving out DOZENS if not SCORES of other American cities.

And here’s young RAMBO himself.

I hope he was merely high.

Sounding It Out

There are moments when music,

Resplendent in chords,

Or flirting intensely

With counterpoint,

Encounters the Tao

Of epiphany

And stretches the limits

Of sound.

There are moments when writing,

Unsure of its thrust,

Weary of structure

But eager for form --

Merging with urges

It can't even name --

Burns with a rare

Incandescence.

There are moments when photos,

Haphazardly shot or

Pilfered from images

Crafted and fleshed,

Posted in batches,

Filtered and cropped,

Extract the unseen

From the wish.

There are moments when strolling

Through grave-yarded streets --

Livened by breezes

That soften the stride;

Women who've blossomed

Where homelessness sleeps --

Embolden the weak

And the wise.

There are moments when sinners

Imploring the past --

Cruelly outwitted

Or thinned by remorse;

Stricken by conscience

And sobered by grief --

Attempt in their way

To atone.

There are moments when silence,

Untainted by speech,

Enveloped in stillness,

And heedless of time --

Released from the spell

Of nostalgia --

Commissions the next

Perfect sound.

JAD, 2022

What the Dream Revealed

It wasn't the moments

Recalled in detail,

The ones he was sure

Had occurred,

But fragments unbidden

And lustered by time,

Revealed in a brilliant

Tableau.

The endlessly runaway

Sunny-day Mays,

The blooms of each

Spiraling June;

The women in closeup,

Their features precise;

The future, a

Ripening hope.

He'd often retreated

In deference to risk,

Conceding to

Beatable odds,

Immune to appeals

For his service,

Unwilling to

Formulate goals.

JAD, 2022

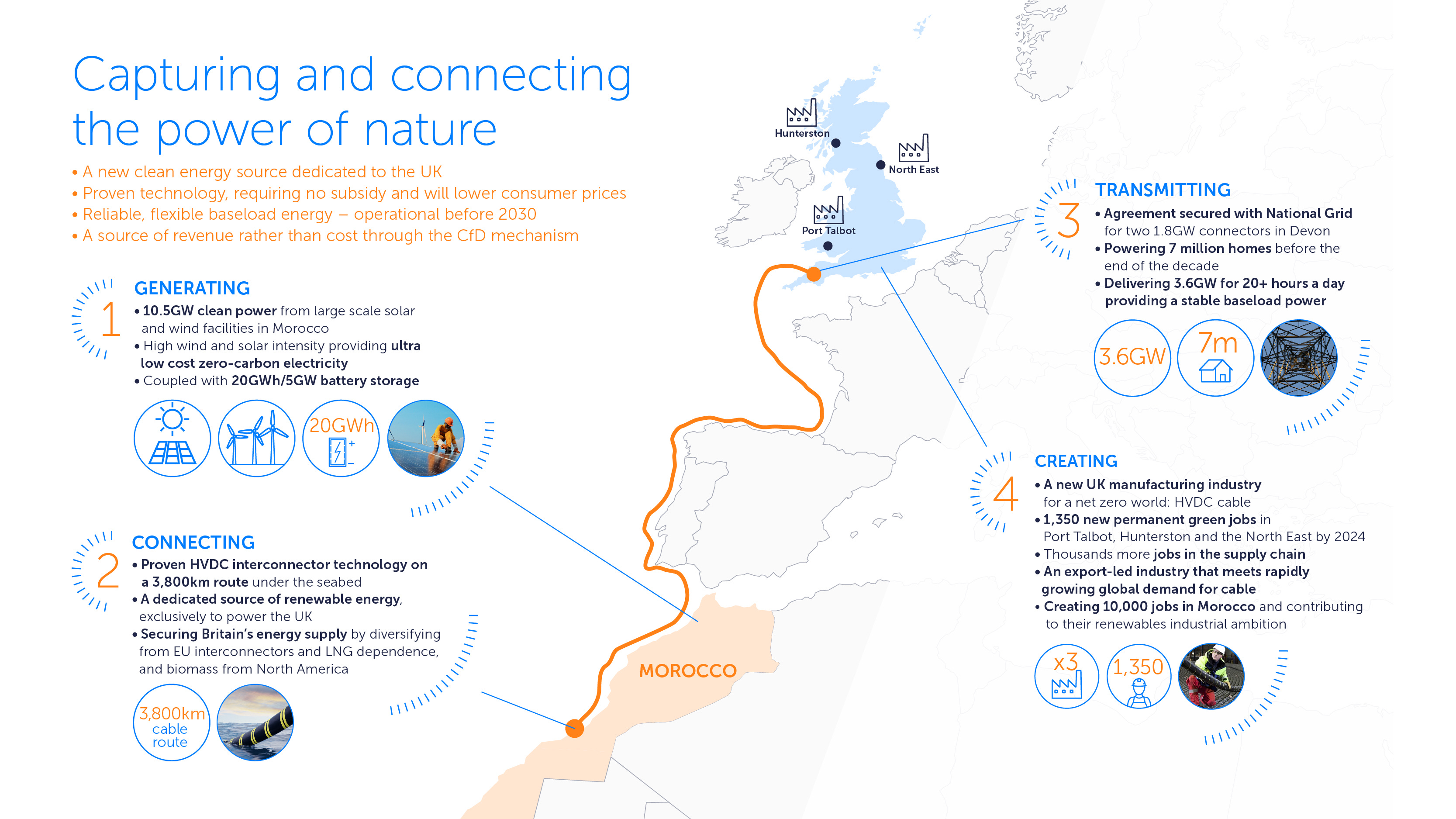

. . . and Delivering It by UNDERSEA CABLE for Distribution in the UK?

And at a cost of $21 billion?

Here’s the full article:

And here’s a graphic of the project, which once completed by a firm called Xlinks, would be the largest solar and wind generation facility in the world.

Inspiring, eh?

But here’s the rub:

“Today’s media is filled with claims of breakthrough technologies poised to revolutionize our relationship with energy. The reporting follows a predictable pattern: sophomoric barbs launched at oil and gas (now, aimed at Putin’s oil and gas, specifically) couched in breathless excitement over the latest promising solution. However, these features do a disservice in that they are almost always heavy on the possibilities and comically light on the constraints.”

Specifically . . .

“That a project such as this needs high and consistent solar incidence, unusually strong and steady nighttime winds, and a massive battery for storage to deliver baseload power lays bare the weakness of most other renewable power projects. It exposes the fallacy of using levelized cost of electricity (LCOE) measurements for projects that produce intermittent power. The real costs of ensuring grid stability that arise as a direct result of intermittency are specifically and knowingly excluded from such calculations, which only serves to obfuscate the real cost/benefit analyses needed to make informed energy policy decisions.”

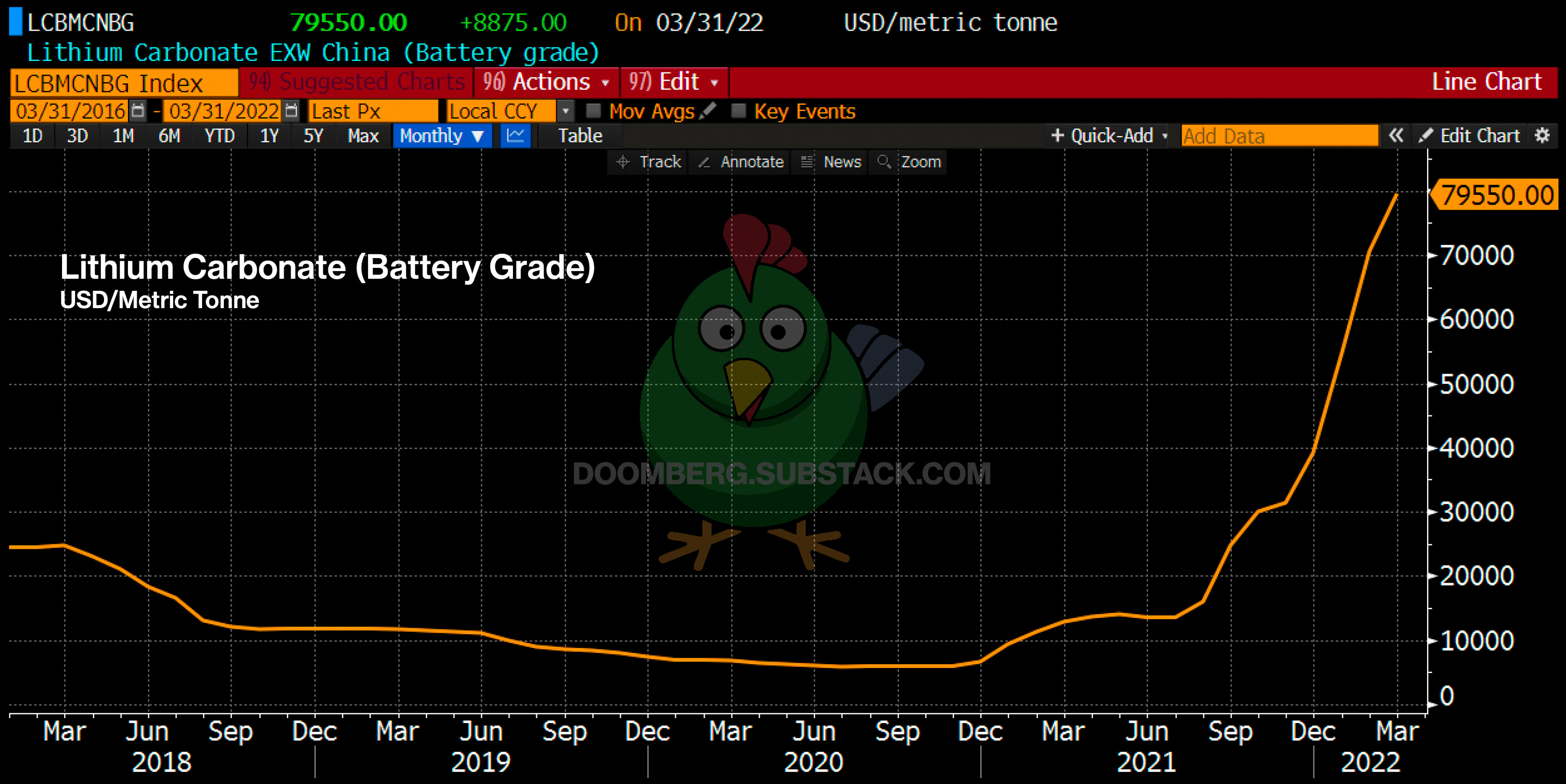

With respect to battery storage, “there are simply not enough “green” metals – cobalt, lithium, and nickel (the key ingredients needed to make lithium-ion batteries) – to facilitate a meaningful transition away from legacy internal combustion engine vehicles as it is, and the Xlinks project would be competing for supply with the powerful OEMs under pressure from heavy-handed emissions targets. The price of Lithium Carbonate over the last year makes clear the magnitude of this challenge.”

Finally, the success of this project will depend on a) the creation of “an export-led cable manufacturing industry in Britain“ and b) an ACTUAL FUNDING SOURCE which DOESN’T AT THE MOMENT EXIST.

ARE OPEC AND PUTIN QUAKING IN THEIR BOOTS?

THE PIECE CONCLUDES THAT THEY AREN’T.

I hope civilization lasts long enough to see this on a BROAD SCALE.

“Physicists in the Netherlands have shown for the first time that quantum information can be reliably teleported between network nodes that are not directly connected to each other. According to the researchers, who created the world’s first three-node quantum network at QuTech (a collaboration between the Delft University of Technology and TNO) in 2021, the latest work marks a further step towards a scalable quantum Internet.”

Yes, we are correct in sensing that the everyday material world is less material every day.

Here’s the article:

It’s in discussion.

From the Guardian:

“Britain has backed in principle a proposal by Lithuania for a naval coalition “of the willing” to lift the Russian Black Sea blockade on Ukrainian grain exports.”

Also . . .

“According to the latest from the UK Times, London remains open to the plan and is in discussion with allies for establishing the “protective corridor” from Odesa through the Bosphorus, but has stopped short of approving that it should move forward at this early phase. It seems that the ‘invitation’ has gone out to allies, however, and the two leaders are actively floating the idea – perhaps also waiting for Washington’s backing.”

A NAVAL BLOCKADE IS AN ACT OF WAR. RUSSIA IS AT WAR WITH UKRAINE AND BLOCKADING ITS PORTS TO PREVENT IT FROM EXPORTING GRAIN. CLEAR ENOUGH.

BUT THEN, HOW DOES ONE DEFINE A NAVAL “PROTECTIVE CORRIDOR” ESTABLISHED BY NON-BELLIGERENTS TO PIERCE A BLOCKADE?

AS AN ACT OF WAR AS WELL?

IT’S POSSIBLE THAT THE WEST COULD ENTER THIS WAR.

AND IF SO, I HAZARD EVEN TO SPECULATE AS TO POTENTIAL UNINTENDED CONSEQUENCES.

What shape is YOUR part of the grid in?

Move over, Dave Chappelle.