As usual, what’s FREEST is found in Scandinavia.

As usual, what’s FREEST is found in Scandinavia.

. . . for Possible Sanctions.

Yes, they have possible moves. But so do the US and the Greater West. We’re now playing chess.

Or is it GO?

And as a matter of law based on GENDER EQUALITY.

Mmm, I wonder when gender equality will ENTITLE one to reequip oneself — USING TAXPAYER DOLLARS — with those MISSING BREASTS or a SURGICAL PENIS. Or will we just start trading SEX PARTS like DERIVATIVES?

My only question is — CAN YOU STILL STARE?

Or will it be construed as VIOLENCE?

Let’s ask these two. They look like EARLY ADOPTERS.

The idea is gaining traction in view of Asia’s punishing “work till you drop” culture.

Apparently, it’s caused productivity to PLUMMET.

I’d bet it’s also KILLING PEOPLE.

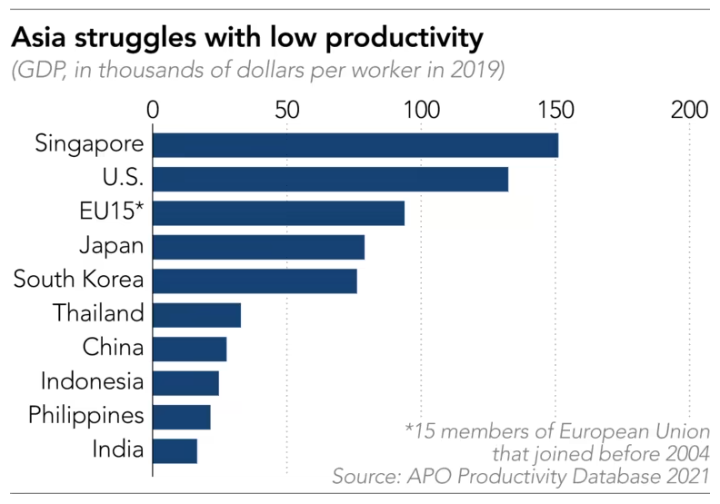

Here’s your productivity crib sheet if you’re scoring at home.

As much as I love American Psycho, Rules of Attraction, the second in Bret Easton Ellis’s trilogy — HIS TREATISE ON GEN X DECADENCE — is just as HILARIOUS and as SCATHINGLY HONEST.

My two favorite clips.

OH, SWEET BIRD OF YOUTH!

Stranded

The mind pleads empty,

Daylight dims,

A train pulls out

Without me.

It doesn't count,

I just arrived

And learned I'll

Have to wait.

I'll pace the platform,

Track my steps

And breathe this

Purer air.

The breeze has quickened,

Turned to wind,

My fingers note

The change.

My nose is dripping

Just a bit.

The pollen's

Nearly here.

I check my phone,

The Yanks won late,

They hit with

Men on base.

JAD, 2022

Gen Z

They say that they don't

Wish to work,

Preferring to pass

As attractive,

As men in name only

Addicted to games;

Or lay-about, stay-at-home

Wives.

Do they sleep with their

Apps and devices --

These avid consumers

Of digits unleashed?

McLuhan, for one,

Saw them looming:

Humans regressing

Towards atomized nodes

Conduits for digital

Flows;

Reality giddily

Gutted in fits

As it fell for each

Hyperreal pose.

Gen Z's horizons

Are streaming on screens.

JAD, 2022

Realization

I gather how it's

Come to this --

This third and final stage;

The need to muster patience;

To wait though disengaged.

What once seemed so

Substantial

Has thinned before my eyes,

Mocked by bland complacence

And certified my lies.

JAD, 2022

What can I say? No group like this before or since.

Brilliantly, stunningly, indefinably special.

There are many ways to wage ECONOMIC WARFARE and still claim you’re NOT at war.

Take the EU, which is considering a ban on Russia’s access to EUROPEAN INSURERS.

Russia has shipping loans, and if they can’t sell their oil because they can’t ship it because THEY CAN’T MANAGE THE VARIOUS RISKS INVOLVED, then they’ll have to SELL THEIR SHIPS.

Check out the tweet below which touches on the interplay between debt, demand destruction and potential loss of marine insurance. It’s RUSSIA’S PERFECT STORM, complete with a ship fire-sale.

But wait!

If Russia CAN’T SHIP, from whom do its current consumers GET THEIR OIL?

And what does the resulting shortage DO TO OIL’S PRICE?

Yes . . .

ENERGY SANCTIONS CUT BOTH WAYS.

Alasdair Macleod is as knowledgeable about precious metals, currencies and monetary systems as anyone out there. He’s also head of research at GoldMoney where Maxine and I both have holdings. So, I trust him.

This is a terrific interview, particularly as respects the development of a Eurasian trade-settlement currency.

In case you can’t watch it — or not all of it — here are my notes:

BUT DO WATCH THE VIDEO!

Jazz + Rock + Brian Auger = KEYBOARD FUSION EXTRAORDINAIRE.

This guy LIGHTS ME UP!

GOD’S OWN DEPRESSION KILLER.