The sweetest saxophone tone?

NO QUESTION.

The sweetest saxophone tone?

NO QUESTION.

. . . well, at least, partially.

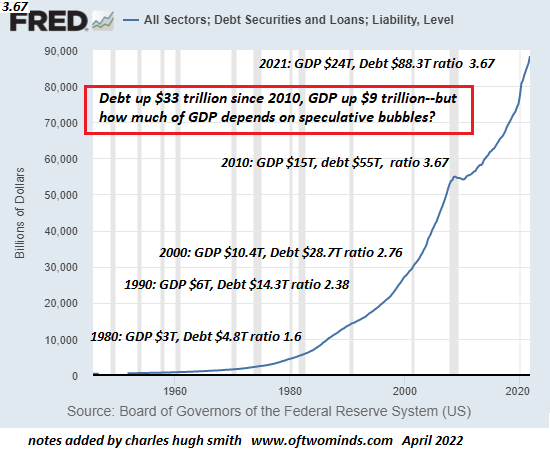

I mean, ENDLESS MONEY PRINTING — like this . . .

. . . WILL PRODUCE CONSEQUENCES LIKE THIS:

But here in the US — is anyone even PAYING ATTENTION?

No, WE’RE PARSING GENDERS and PRINTING.

The entire piece from QTR’s Fringe Finance:

Is there an ACADEMY AWARD for MOST MEANINGFUL AND ARTICULATE INTERVIEW?

If there is, THIS ONE would be my NOMINEE.

Two great minds and about 400 combined IQ points meet and discuss the following subjects:

CHECK OUT WHAT A CIVILIZED DISCOURSE CAN — AND DOES — SOUND LIKE BETWEEN A TRADITIONAL CONSERVATIVE WHO WAS A SOCIALIST AS A YOUTH AND A CIRCA 1960 LIBERAL DEMOCRAT.

As my former therapist, Doctor Lehrer, used to say, WE’RE A LOT MORE SIMILAR THAN WE ARE DIFFERENT.

THIS ONE IS FOOD FOR THE SOUL.

Women’s Educational Status Predicts Their Children’s Educational Status

You Go to War with Words

The Logos is the Antidote to the Apocalypse

. . . Default Bullish Case for Stocks and the Economy

(Spoiler Alert: This is satire)

IT’S A HARD RAIN THAT’S GONNA FALL, EVEN AS A HARD LANDING AWAITS SPACESHIP BUBBLE.

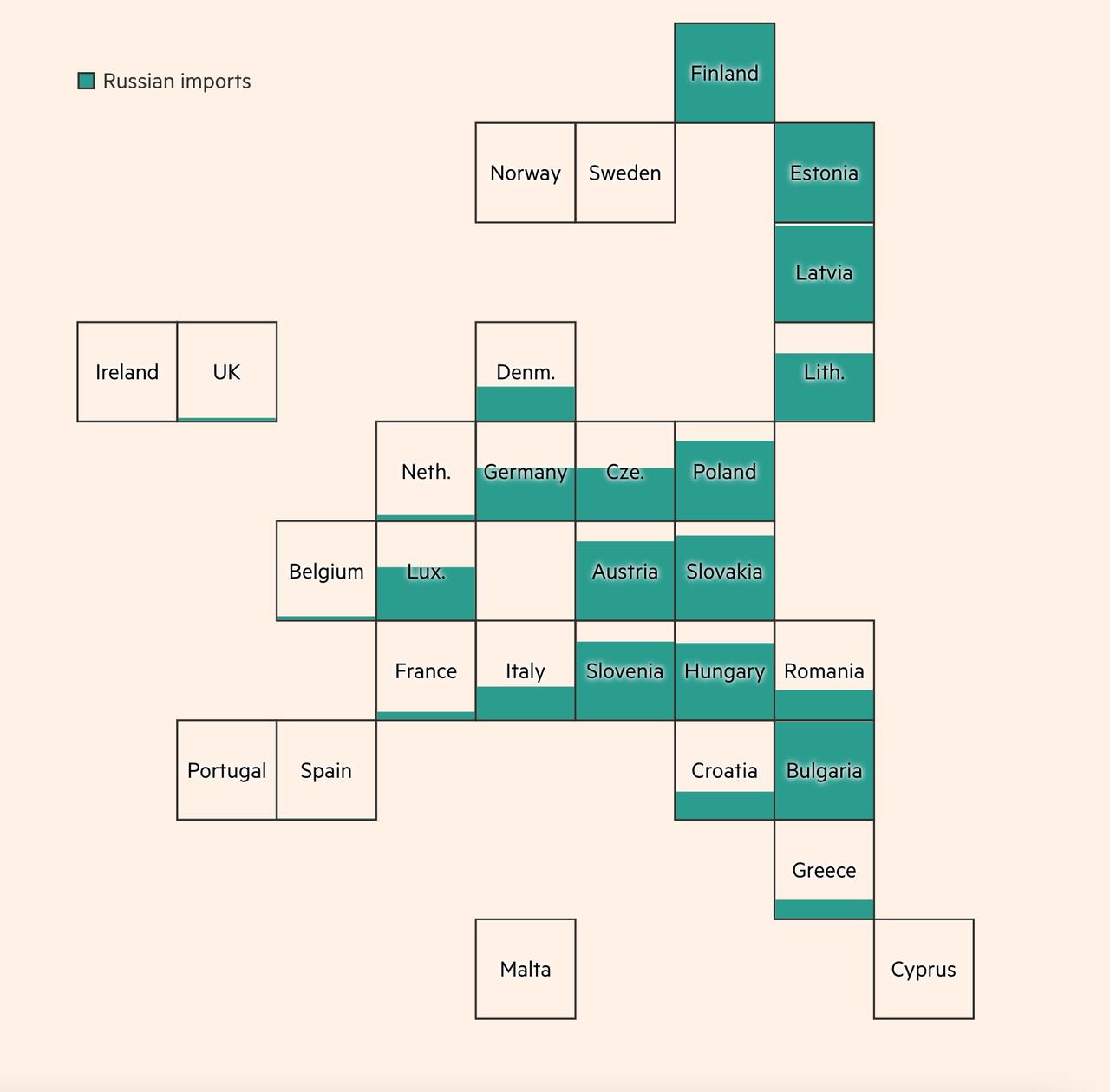

Trade 101 up in smoke. But for some EU countries, not so much.

And, oh, to be a NORWEGIAN!

But, honestly . . .

WHAT HAPPENS NEXT WINTER?

The Oedipus Complex as Relational

Mephistopheles’ Existential Guilt

Commit to at Least One Thing

On the Square

Image-drunk on street-scene funk,

I'm high-hat Cobham high,

As fusion courses coarsely

In both my wired ears.

Andy, Andy, cross the square

And flash your silver hair.

Those you see here meekly benched

May wish to play tonight.

I've sidled past the

Evening rush,

The faces last recast;

Punctured time and

Circumstance

And left them bleeding light.

Dish me up some appetite,

Or fish me out a year.

Any reference, near or far,

Will steer me straight enough.

Fear lies latent, numb as lead,

As passion gasps for breath.

Soothed by evening's warm massage

And tempered by its length --

Thrilled again to roam these streets --

I'm poised for what comes next.

JAD, 2022

And in places, CHEEK BY JOWL. Perfect for viral transmission.

Charles Hugh Smith surely thinks so:

“When the system can’t borrow more and distribute the insolvency, it implodes.”

Or put another way:

Ready for more financial analysis/root canal?

“After 13 long years of declining interest rates and stagnant incomes for the bottom 90%, we’ve finally reached debt saturation: after dropping to near-zero, interest rates are now rising, pushing the cost of debt service higher, while wages are losing purchasing power (a.k.a. inflation), so there’s less disposable income left to service debt.

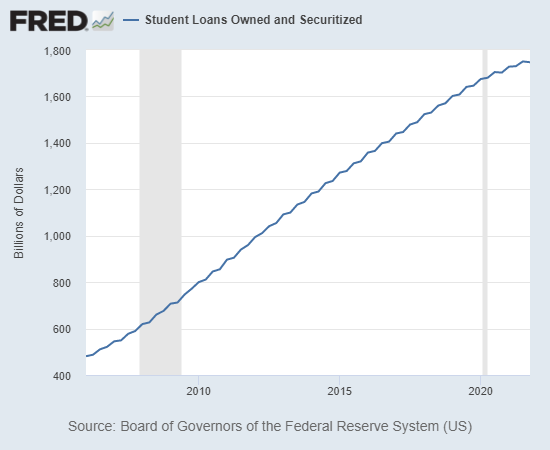

“The game plan for the past 13 years was to fund “growth” today by borrowing vast sums from future incomes: the $1.6 trillion in student loan debt, for example, was supposed to be paid by the soaring wages of all those student-loan-serfs, and all the sovereign debt was supposed to be paid by the soaring tax revenues from rapidly expanding economies.”

WHAT FOOLS OTHER THAN MAINSTREAM AND/OR GOVERNMENT ECONOMISTS BELIEVED THAT THIS WAS EVEN REMOTELY POSSIBLE?

DEAR READERS, WE WERE WINGING IT AND HOPING FOR SOME KIND OF WINDFALL GROWTH- MIRACLE!

SILLY US!

More ROOT CANAL:

“Saturation is an interesting phenomenon. You keep adding more and more to a system that seems to absorb “more” with no ill effects, and then suddenly the whole mountainside gives way and rumbles off the cliff.”

“There’s a runaway feedback loop aspect to debt saturation. Think of a planetary atmosphere where you keep adding greenhouse gases. The atmosphere keeps absorbing more greenhouse gases with little effect until a saturation point is reached and then the atmosphere loses its negative feedback mechanisms that kept the system stable.”

For example, here’s the game we’ve been playing re STUDENT LOANS. It’s called “TEMPORARY DEBT FORGIVENESS:”

Dr. Hughes drilling down:

“The “temporary debt forgiveness” ploy is staving off the day of reckoning in student loan serfdom. Rather than admit the student loan scam is unsustainable, the status quo plays an absurd game of pushing the date that student loan interest will have to be paid forward. This works until it doesn’t.”

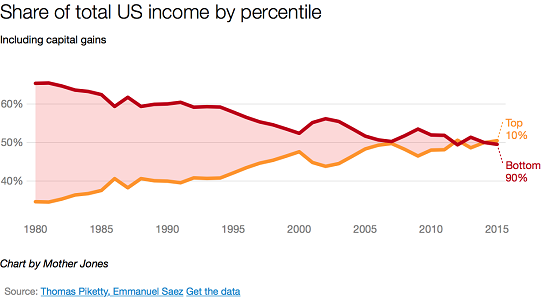

The even crueler reality is that MOST PEOPLE in this country HAVE LITTLE OR NO MONEY. Check this out:

And this:

“The point is wealth and income are highly concentrated in the U.S., so claiming households have plenty of wealth and income is a gross distortion.“

“Those who need to borrow more to survive can’t borrow more: households, zombie corporations, and local and national governments.”

And here’s where Smith thinks we are and are going:

“There’s no tricks left to keep expanding debt: rates are rising, not falling, and wages are losing ground to the soaring costs of rent, adjustable mortgages, healthcare, childcare, food, energy, junk fees, property taxes, etc. As for the phantom wealth of bubbles: as rates rise and the Federal Reserve trims its stimulus, all the bubbles will pop.”

DO AVERAGE AMERICANS, DESPITE THEIR FINANCIAL CHALLENGES, SEE JUST HOW BADLY THINGS COULD TURN OUT FOR THEM? I DOUBT IT.

PEOPLE WON’T KNOW WHAT HIT THEM.