As well he should.

Talk about making someone’s job more difficult.

As well he should.

Talk about making someone’s job more difficult.

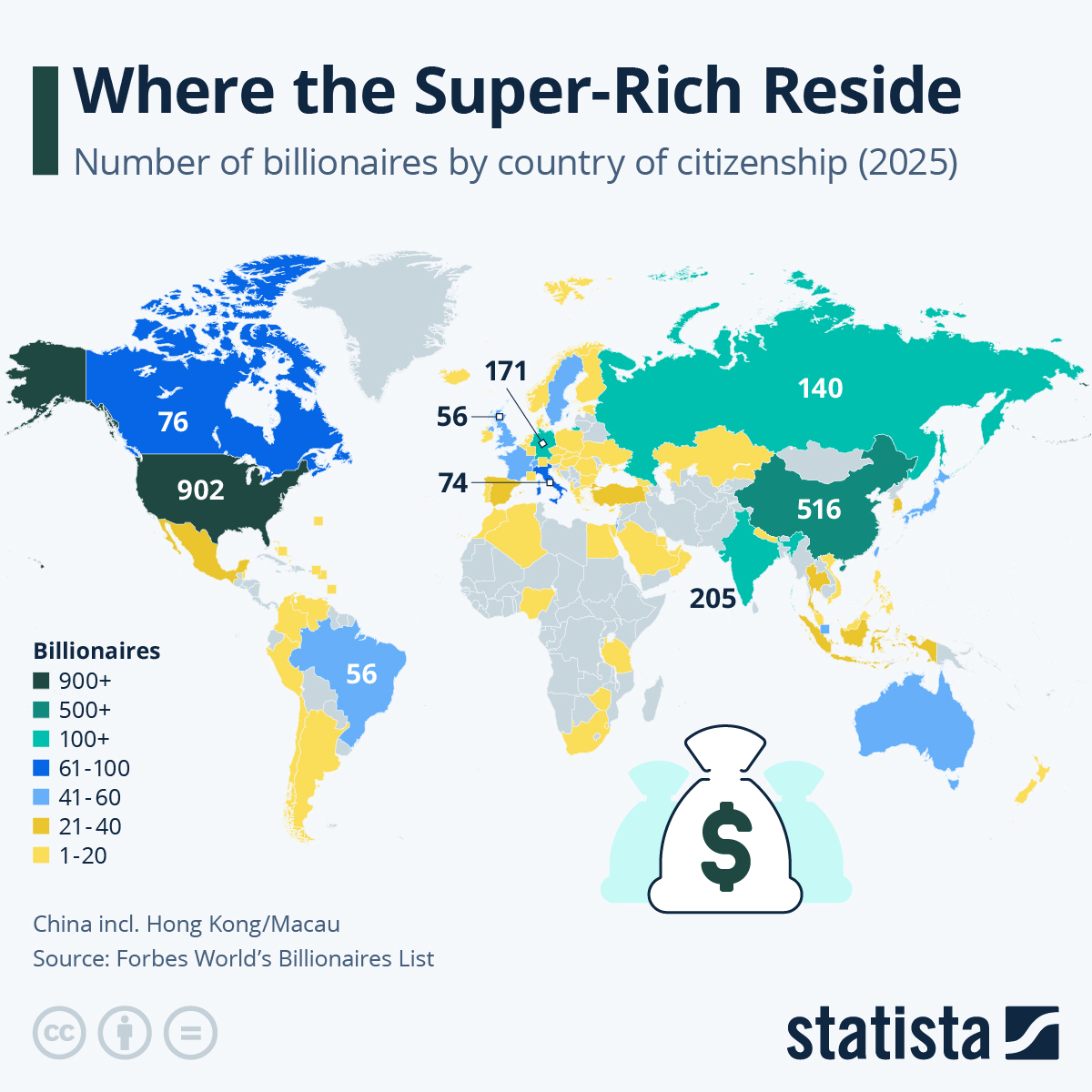

Follow the money geographically.

Fascinating look at Peterson tight-roping the Bitcoin phenomenon before a Bitcoin audience. Agree with him or not, few can FRAME AN ARGUMENT like Peterson, while at the same time SPICING IT with EVIABLE ERUDITION.

Watch him PITCH, HEDGE and ANALOGIZE:

If I were still a beer drinker, I’d favor Prague as the best value for money.

At least in HIS VIEW.

But as he’s one of the world’s leading copper traders, HIS VIEW’S WORTH A LOOK.

And another:

Here’s my summary, bearing in mind that this is merely ONE TRADER’S VIEW:

EVOLUTION OF THE GLOBAL ECONOMY

THE COMING EURASIAN CURRENCY

CHINA’S HEADWINDS

THE FUTURE

The rest of the videos deal with copper and broader investment issues which to me were of less relevance than the above described EURASIAN CURRENCY GAMBIT.

Again, this information is reflective of MERELY ONE MAN’S VIEW. But given both his acumen and experience, much of what he discusses here is SO PLAUSIBLE as to fall easily within the range of the POSSIBLE, if not PROBABLE.

That said, this analysis doesn’t take into account potential MAJOR DISRUPTIONS occasioned by either WAR or ENERGY SHORTAGES, both of which are already CURRENTLY IN PLAY.

From Daniel Lacalle via the Mises Institute:

European Environmentalists Have Made Energy Independence Impossible

Some notable points — all direct quotes:

HAS ANYONE EVER SEEN EVEN ONE COMPREHENSIVE STRATEGY AND/OR ACTION PLAN TO TRANSITION FROM FOSSIL CARBON ENERGY SOURCES TO WHATEVER?

NO.

THERE ISN’T ONE.

As per former French Intel director, Pierre Brochand:

“All ‘multicultural’ societies are doomed to more or less deep rifts,” warned Brochand, adding, “In such a situation, it happens that minorities are violent winners, and majorities placid losers.”

Worse, Brochand sees civil war as a distinct possibility in his NATIVE FRANCE:

“This gradual upheaval of the French population, if not the only challenge we face, is the only one that directly threatens civil peace on our territory,” said Brochand, warning that Muslim migrants and others from outside of Europe have developed a “spirit of post-colonial revenge.”

HONESTLY, IS MASS MIGRATION ACTUALLY HELPING FRANCE, THE SECULAR NATION-STATE?

I CAN’T SEE HOW.

It would now seem logical.

But then, would Russia attack them — particularly Finland — before they’d been formerly accepted under NATO’s umbrella? And hence INELIGIBLE for a unified NATO counterattack?

I’m sure Jens Stoltenberg had this in mind when he recently talked of FAST-TRACKING their membership.

MAY IT HAPPEN.

. . . vs. Manhattan.

How do I know this is an accurate comparison? At least on the Manhattan end?

Maxine just bought a coop apartment across the street from our current one — a kind of CAT ANNEX — and we’ll be paying ALMOST EXACTLY this amount in monthly maintenance for ALMOST EXACTLY this much usable space.

Actually, when you throw in the closet and bathroom, we’ll have closer to 300 sq. ft., but, hey, CLOSE ENOUGH.

Check out the VIDEO TOUR. But remember. It’s Manhattan, not Wichita. Because in Manhattan, you trade SPACE FOR PLACE.

And check out those views.

WHO KNOWS?

And whether it withers?

WHO KNOWS?

Thoughts and charts from Michael Lebovitz at RealInvestmentAdvice.com:

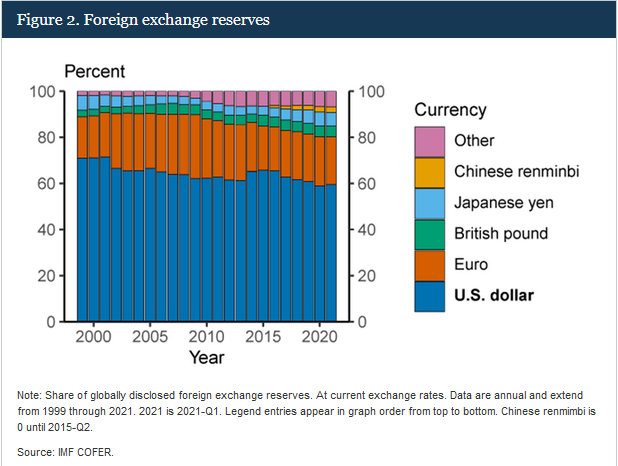

FOREIGN EXCHANGE RESERVES — WHAT CB’S CURRENTLY HOLD

Dollar, dollar, rise or fall, STILL THE STRONGEST OF THEM ALL.

“Despite Washington’s reckless monetary policy and burgeoning trade and fiscal deficits, the dollar remains the world’s reserve currency. The benefit to the U.S. is that countries with dollar reserves must invest in U.S. Treasury securities regardless of yields. As a result, about a third of U.S. Treasury bonds are held by foreign entities. Given the ability to run massive deficits and fund them easily, it should not be surprising that American politicians want to keep the dollar as the world’s reserve currency.”

RUSSIA’S DILEMMA

Directly linked to the Dollar’s future is this:

“Russia has a colossal trade problem on its hands. In addition to many countries boycotting trade with them, their foes are likely not willing to accept rubles as payment for goods.

“Why? For starters, there is no rule of law in Russia. Add to that a flawed and corrupt banking system and illiquid securities markets. Further, Russia most recently defaulted on its debt in 1998 and could easily do so again.”

The Volatile Ruble

Gold Uber Rubles and Dollars?

Despite sanctions, TRADE WITH RUSSIA will continue.

“Russia would like to pay for foreign goods with rubles and receive gold or rubles for their goods. However, we doubt their trade counterparts have a desire to accept rubles for the reasons we note. Given that using dollars and euros is now exceedingly difficult, and no one wants rubles, the only feasible currency alternative is gold.

“Gold, however, presents a different set of headaches due to the transportation and storage requirements to keep it safe.”

But with gold, there are always WORKAROUNDS.

“For example, if Pakistan wants Russian goods, they can convert their rupees to gold and gold to rubles to complete the transaction.

“Russia and other countries can retain their gold within their respective borders and not fall prey to seizure as is occurring with its dollars.”

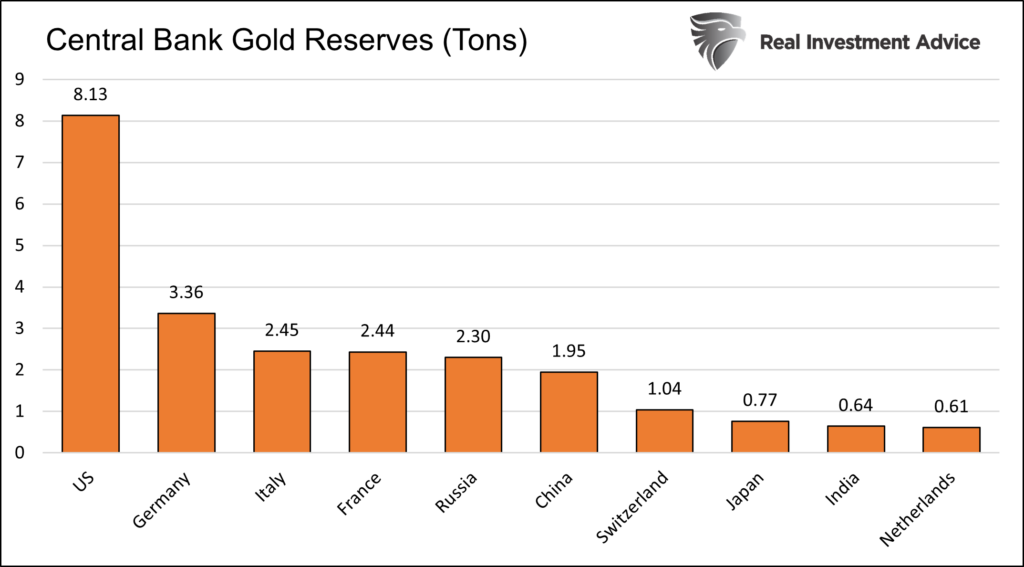

GOLD STOCKS

While gold no longer DIRECTLY backs currencies, all major CB’s hold it as part of their reserves.

CRYPTO?

For now an UNLIKELY MAJOR PLAYER. Two issues:

SUMMARY

“We are not suggesting the dollar loses reserve status. But we do want you to consider that some countries now have more incentive to seek an alternative payments source to the dollar. Gold is not the only solution but a currency that has worked for millennia and is helping Russia today.”

HOWEVER, THERE IS THIS:

‘IMF WARNS RUSSIA SANCTIONS THREATEN TO CHIP AWAY AT DOLLAR DOMINANCE.’

So, don’t go with God . . . or the Dollar.

GO WITH GOLD.