Latest Russia-Ukraine War related observations from Rabobank’s Chief Global Strategist. And I’m quoting.

- The Russian Defense Ministry officially released data showing 9,861 Russian troops have been killed, with 16,153 injured. That is getting close to the tally of the entire 11-year Soviet invasion of Afghanistan.

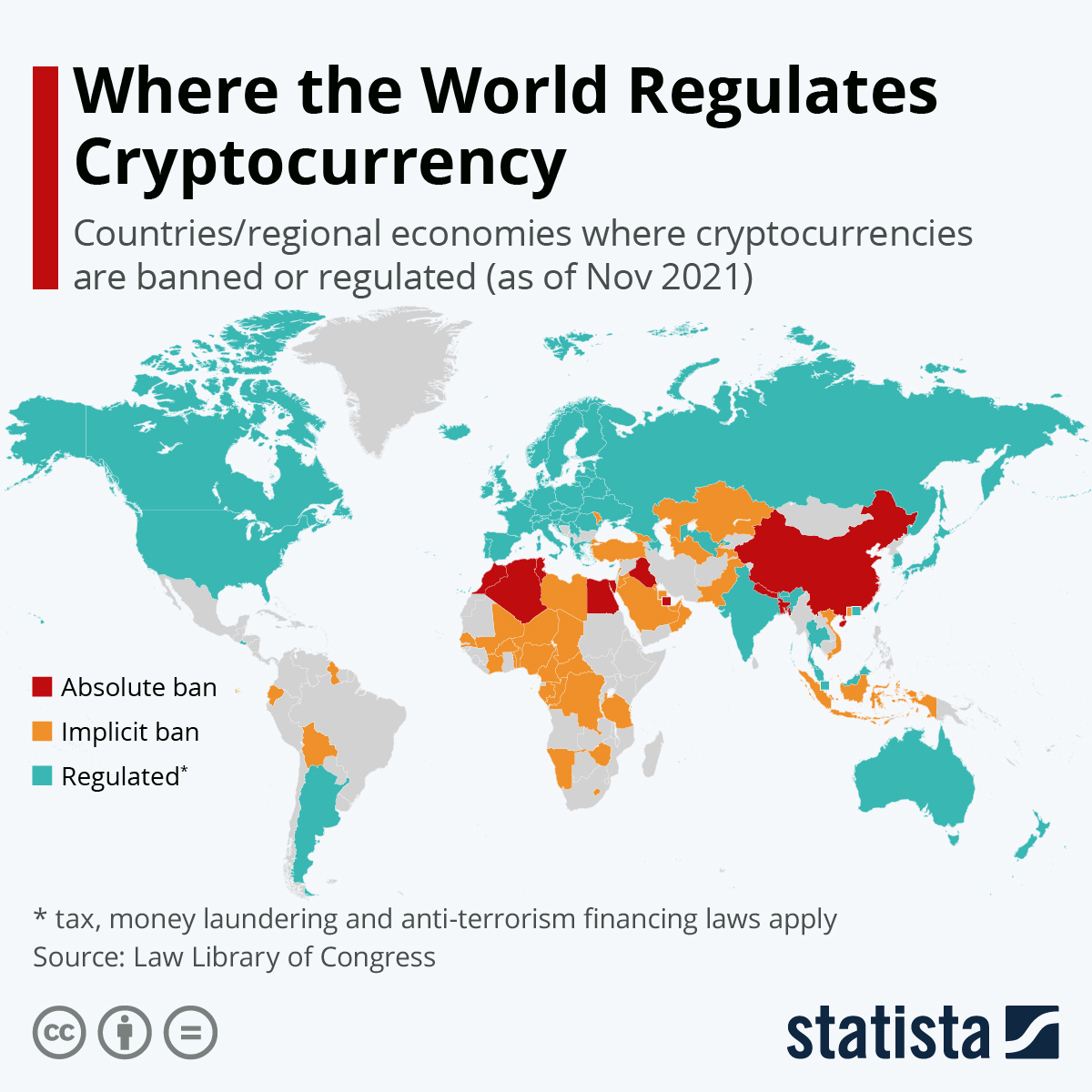

- The US also decided it needed escalation on another front – it sanctioned Chinese officials over human rights abuses related to Xinjiang and the treatment of Uighurs, an issue which seemed on the backburner.

- Quite clearly to some, this is a shot across the bows about Chinese support for Russia. Equally clearly to most, it will generate a furious Chinese backlash. And this is as Russia warns it is close to severing all diplomatic ties with the US completely. In short, our pre-war scenario C –messy global fragmentation– looks a step closer to potentially materializing.

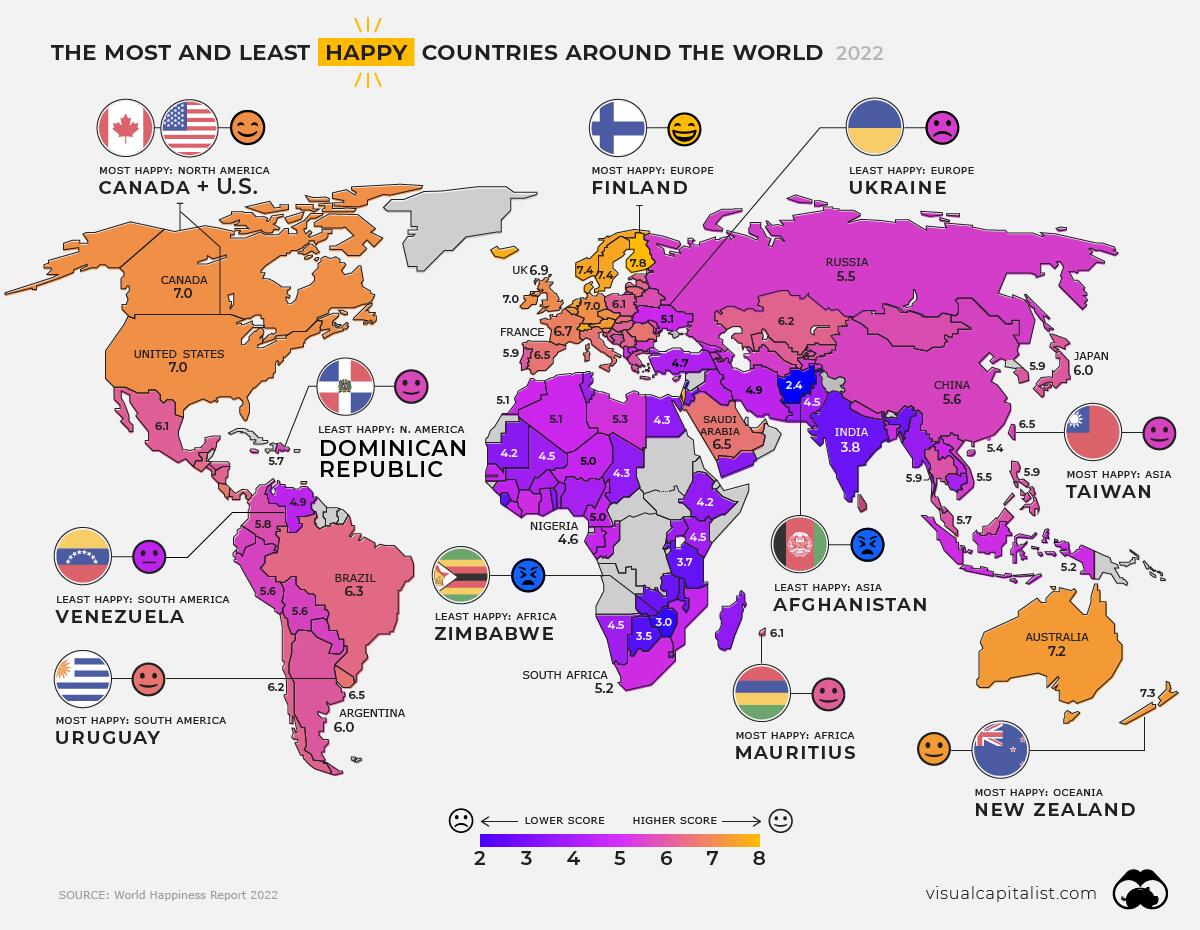

- The problem is, of course, that while the free world is increasingly united, most of the world isn’t free in that sense. Indeed, while we all congratulate ourselves on how ‘Ukraine has won the media war’, consider that this is not how it is playing out in swathes of Asia, Africa, or even Latin America. And unless the West intends to leave all of these economies to set up a new bloc without it, which the current scramble for energy shows is not possible, it needs to do better, or at least make a more substantive offer.

- Against this backdrop, what is a central bank to do? If you listened to Fed speakers, especially Powell, yesterday, you heard them suggest raising rates faster, perhaps going 50bp and not 25bp at some meetings, and removing QE even more aggressively. If you listened to the ECB’s Lagarde, you got a very different message.

- Stocks are generally holding up on the view that this hawkishness is aberrative silliness that will soon give way to the usual QE and money on a plate for those who never have to worry about what’s on their plate, even as hundreds of millions literally risk having nothing on theirs.

- Yet if we are seeing a struggle for a new world order, you can make a strong case that a sign of health, not weakness, would be higher interest rates in the country aiming to lead it.

- Freedom isn’t free; and freedom isn’t free money.

DON’T BE SURPRISED IF THE US CAN’T CONTROL OUTCOMES IN A WAY TO WHICH IT HAS BECOME ACCUSTOMED.

POWER IS NOW MORE DIFFUSE.