From Eric Peters, CIO, One River Asset Management:

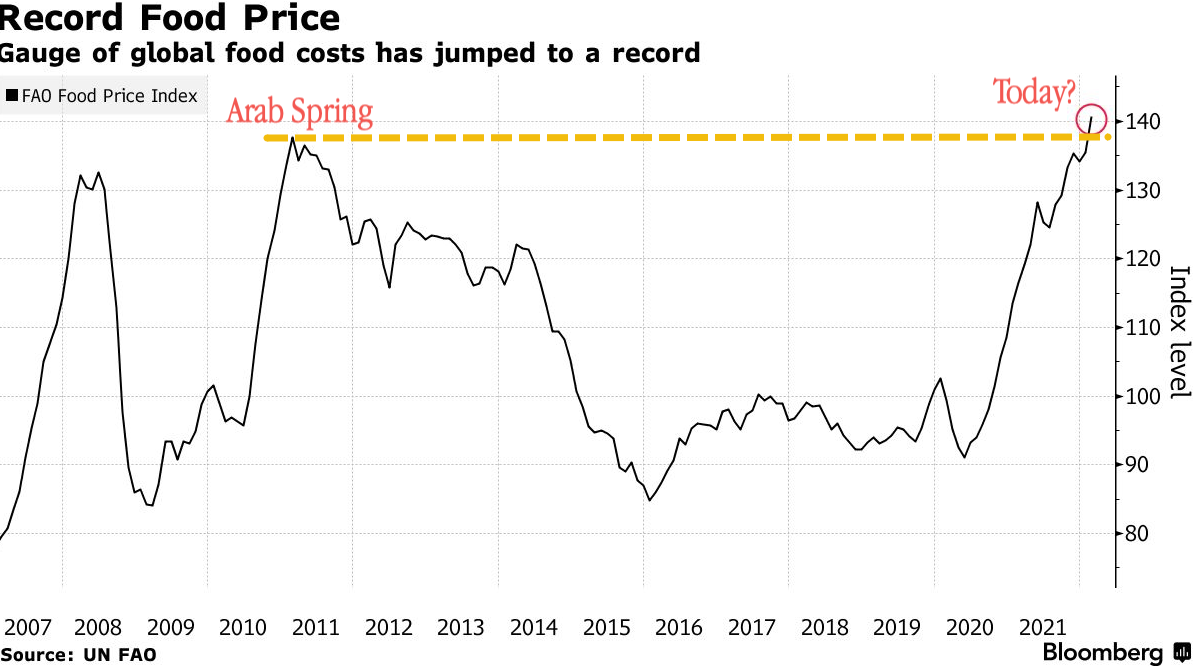

“Golden Eras: ‘The coronavirus pandemic will mark the dividing line between the deflationary forces of the last 30-40yrs and the resurgent inflation of the next two decades,’ said economist Charles Goodhart, author of The Great Demographic Reversal. He sees inflation in developed economies settling in at 3-4% by the end of 2022 and remaining elevated for years. The addition of hundreds of millions of inexpensive Chinese and Eastern European workers, together with Western baby boomers and women led to a doubling of the workforce supplying advanced economies from 1991-2018.

“Golden Eras II: The working-age population is shrinking across developed economies (in China by 100mm in the next 15yrs). Businesses will manufacture and invest more locally, re-designing supply chains. Global savings fall as older people consume more than they produce — spending particularly on healthcare. US manufacturing wages are less than 4x those in China (versus 26x when China joined the WTO in 2001). With global debt at record levels and asset prices elevated, Goodhart expects central bankers will struggle to tame inflation without causing a deep recession. ‘A golden era for central banking is ending, life will become a lot harder.’”

OR THERE WILL BE CHANGE NO ONE NOW FORESEES WHICH WILL RESULT IN THINGS BEING BETTER, WORSE OR JUST AS THEY ARE.