TUDOR PLACE: Or will it be “merely” ECONOMIC COLLAPSE?

This is an extremely TRENCHANT analysis of what Russia’s attack on Ukraine LIKELY MEANS. And it’s one that connects Russia’s aggression to resource depletion, energy prices, interest rates and debt. In other words, it’s both COMPREHENSIVE and SYSTEMIC. Plus, it’s LOGICAL.

Tverberg’s opening paragraph:

“Russia’s attack on Ukraine represents a demand for a new world order that, over the long term, will support higher prices for fossil fuels, especially oil. Such an economy would probably be centered on Russia and China. The rest of the world economy, to the extent that it continues to exist, will largely have to get along without fossil fuels, other than the fossil fuels that countries continue to produce for themselves. Population and living standards will fall in most of the world.”

TP: She continues . . .

“If a Russia-and-China-centric economy can be developed, the US dollar will no longer be the world’s reserve currency. Trade will be in the currency of the new Russia-China block. Outside of this block, local currencies will play a dominant role. Most of today’s debt will ultimately be defaulted upon; to the extent that this debt is replaced, it will be replaced with debt in local currencies.“

TP: This could result in profoundly negative effects on the US, Greater West and their remaining Asian allies while at the same time unleashing a cryptocurrency “multiverse” that could further UNHINGE things.

Tverberg:

“As I see the situation, the underlying problem is the fact that, on a world basis, energy consumption per capita is shrinking. Energy consumption is essential for creating goods and services.”

TVERBERG’S KEY POINTS:

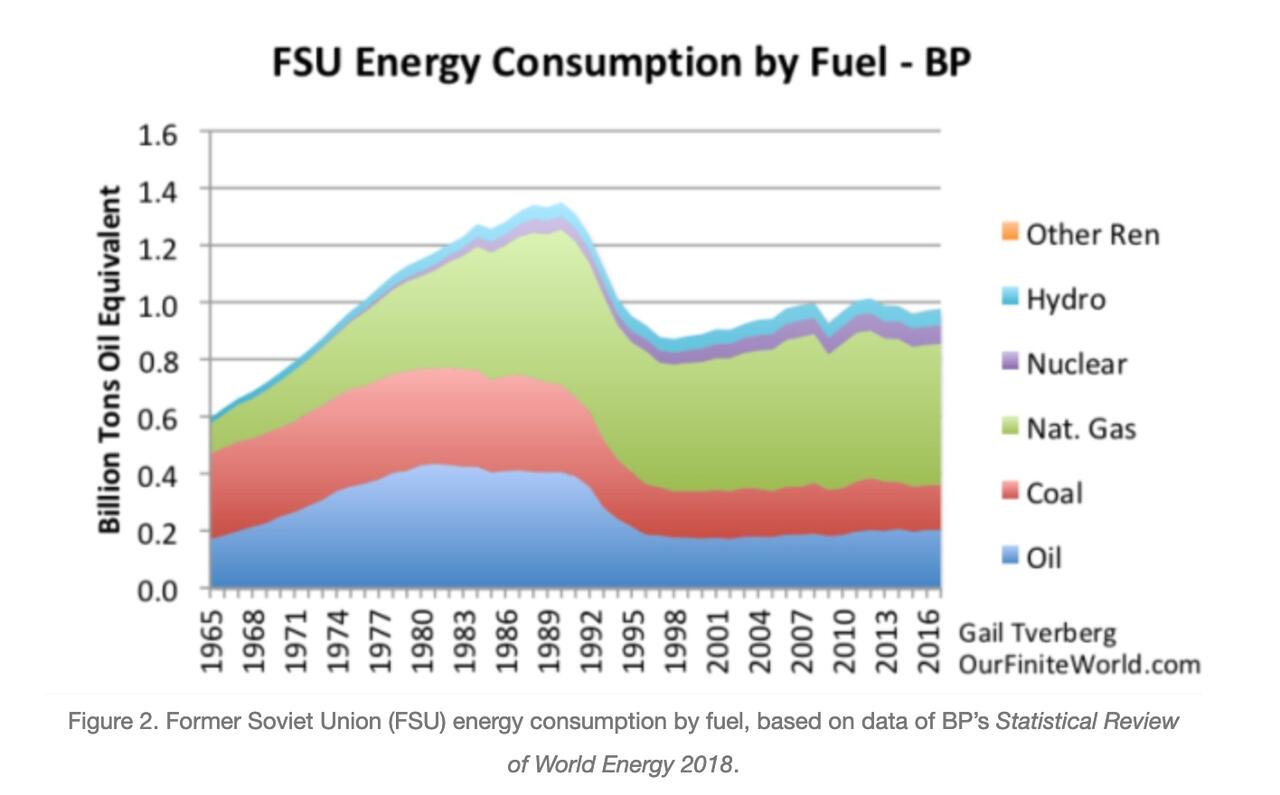

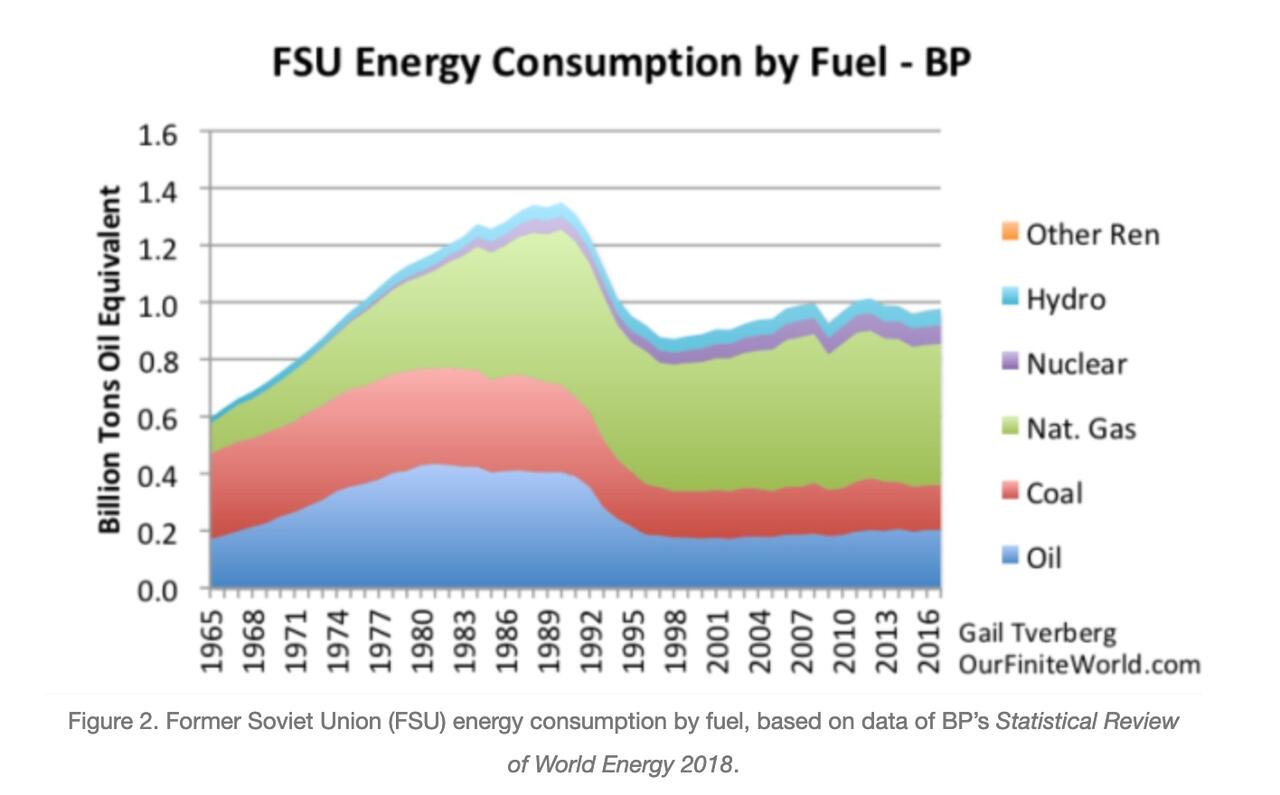

[1] It appears that Russia now fears that it is near collapse, not too different from the collapse of the central government of the Soviet Union in 1991. Such a collapse would lead to a huge drop in Russia’s living standards, even from today’s relatively low level.

TP: Russia’s attack on Ukraine may be better understood as an ECONOMIC SURVIVAL/GLOBAL-REORDERING MOVE than as a DIRECT RESPONSE to potential encroachment by NATO per se. The idea being that in order for Russia, as now constituted, to survive, it’s not only incumbent upon it to defend against NATO, but, in fact, to UNDERMINE IT by going on the offensive.

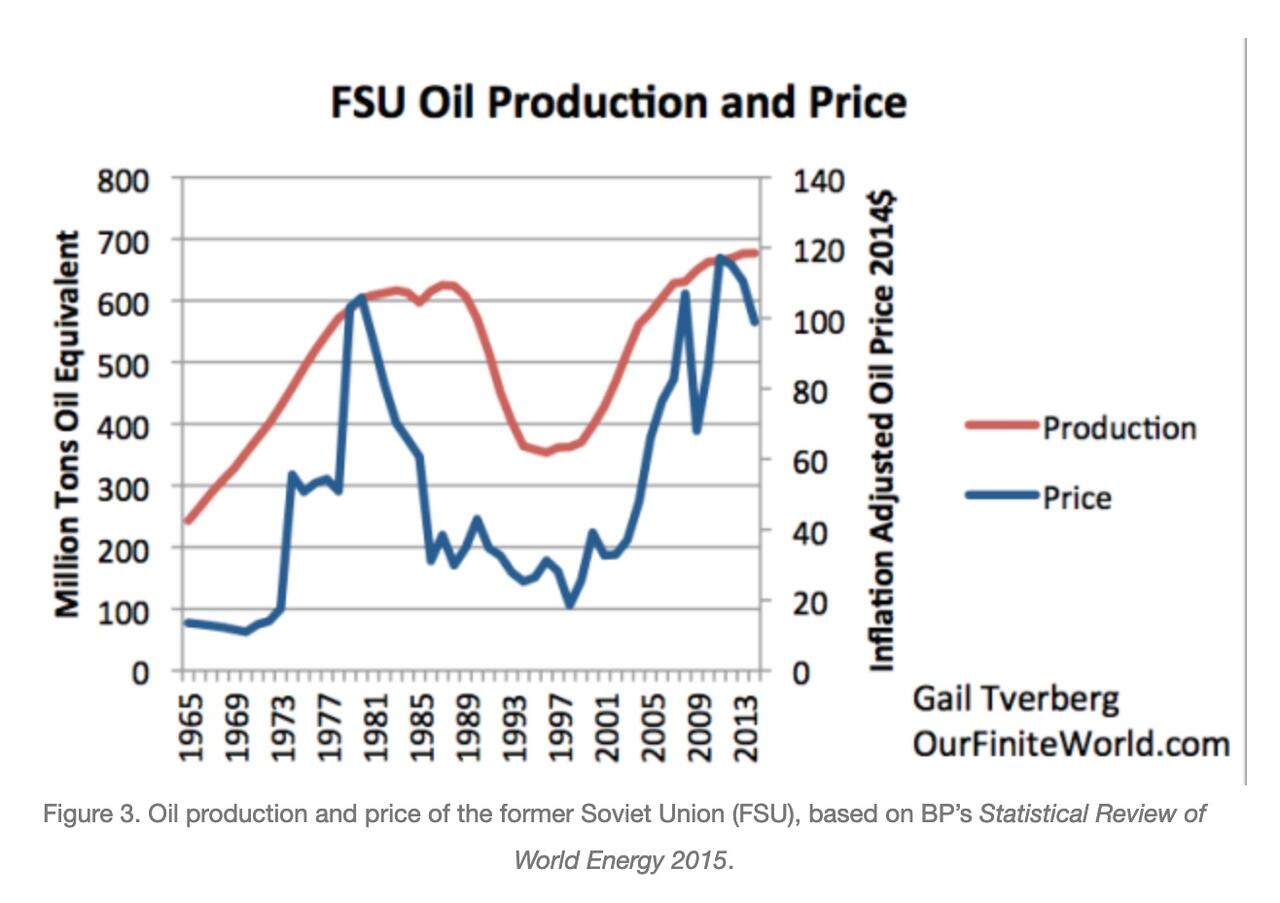

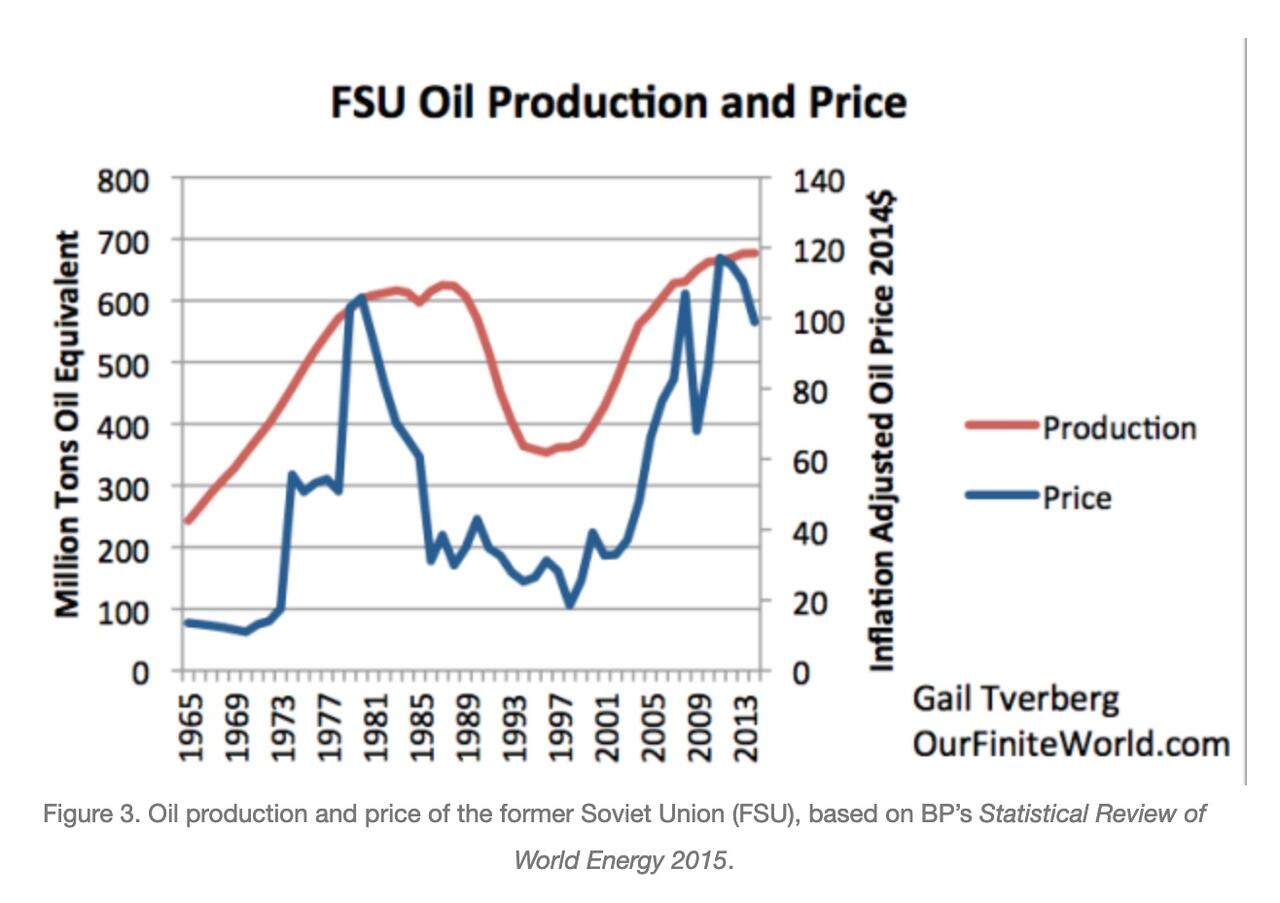

[2] The thing that seems to have been behind the 1991 collapse is the same thing that seems to be behind Russia’s current fear of collapse: continued low oil prices.

TP: And here Tverberg makes what I consider an astonishing point — A CONCEPT I’VE NEVER BEFORE SEEN IN PRINT, viz. THAT ONCE ECONOMIC VIABILITY SHRINKS BELOW A CERTAIN POINT, THE COST OF SUPPORTING NATION-STATE GOVERNMENT AT THE HIGHEST LEVEL BECOMES UNAFFORDABLE:

- “I believe that these chronically low oil prices ultimately brought down the top layer of the government of the Soviet Union. This is because of the physics of the situation.

- “As the total energy that could be purchased by the system fell because of low prices received for exports, it became impossible to support this top level of governmental services.

- “This top layer was less essential than the lower levels of government, so it fell away.”

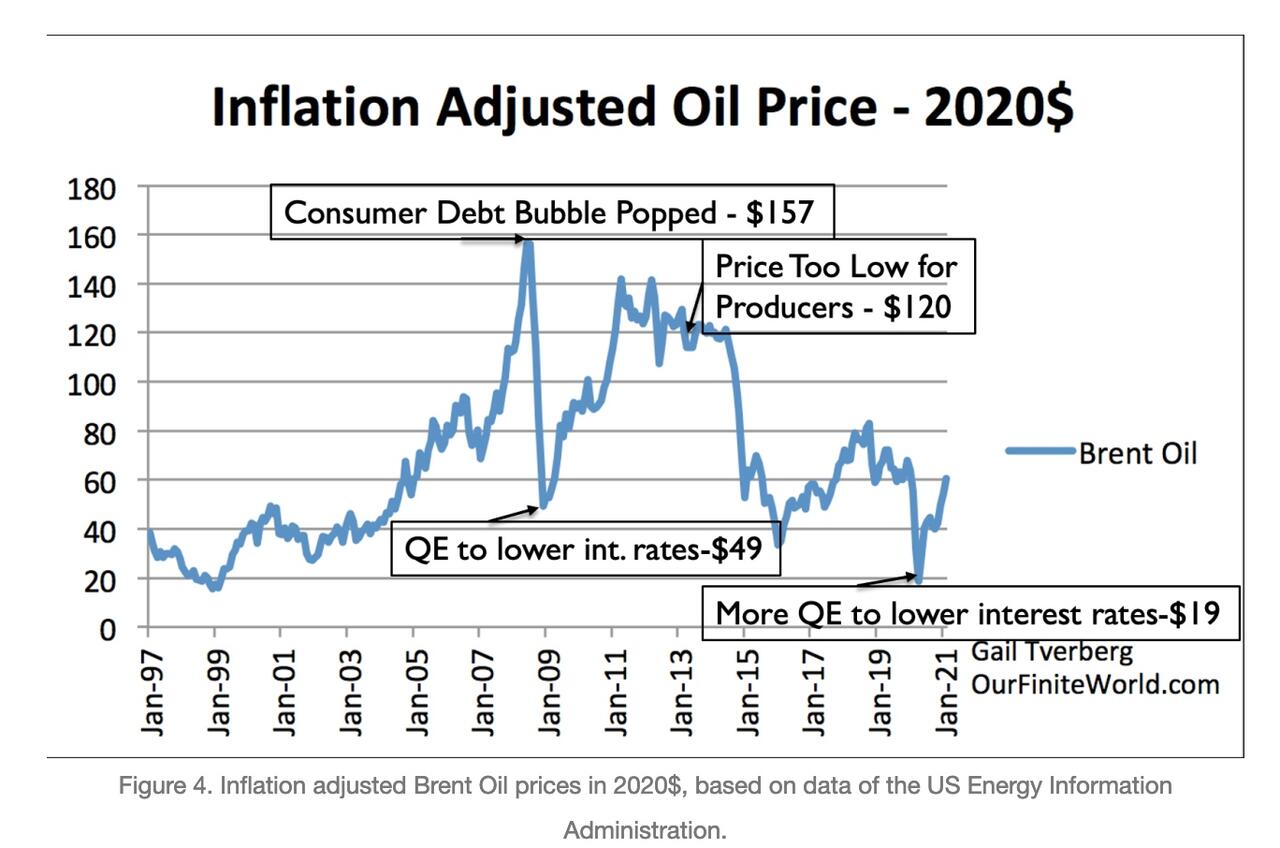

TP: Tverberg next points out that oil prices — on an inflation adjusted basis — have been relatively low since the beginning of 2015.

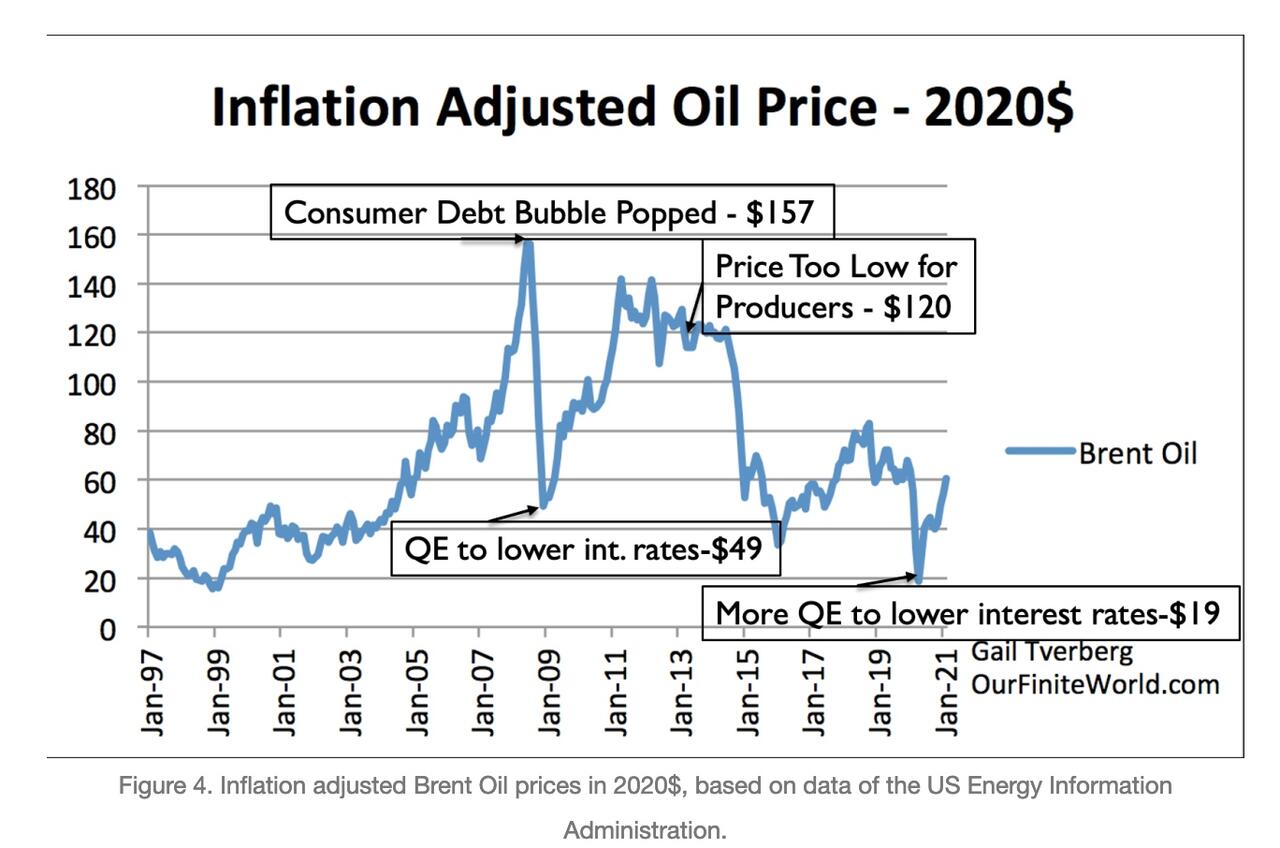

- [3] While oil prices depend on “supply and demand,” as a practical matter, demand is very dependent on interest rates and debt levels. The higher the debt level and the lower the interest rate, the higher the price of oil can rise.

TP: As Tverberg notes, “even before the Ukrainian invasion, oil prices [had risen] about as high as they could go, through low interest rates and generous debt availability . . . Even now, with all the disruption of the attack by Russia against Ukraine, oil prices are below the $120 threshold that producers seem to need. This price issue, plus the corresponding low-price issues for natural gas and coal, is the problem that Russia is concerned about.”

- [4] The fundamental problem behind recent low oil prices is the fact that the current mix of consumers cannot afford goods and services produced using the high oil prices that producers, such as Russia, need to operate, pay high enough wages, and do adequate reinvestment.

TP: And here’s another MONEY SHOT . . .

“To try to hide the increasingly difficult problem of keeping [oil] prices both high enough for producers and low enough for consumers, central banks have lowered interest rates and encouraged the use of more debt.”

In other words, the FUNDAMENTAL NEXUS at play here is: OIL PRICE/DEBT AVAILABILITY/INTEREST RATES.

[5] No one knows precisely how much oil, coal and natural gas can be extracted because the quantity that can be extracted depends on the extent of the price rise that can be tolerated without plunging the economy into recession.

TP: But if consumers can’t tolerate oil priced at over $80 a barrel while producers of major fields require $120, where does that leave us? Says Tverberg:

“Both oil and gas producers and coal producers can be expected to go out of business because prices do not leave a sufficient margin for the required investment in new fields to offset the depletion of existing fields. Renewables will falter, as well, because both building and maintaining renewables requires fossil fuels.”

LET THAT SINK IN FOR A MOMENT.

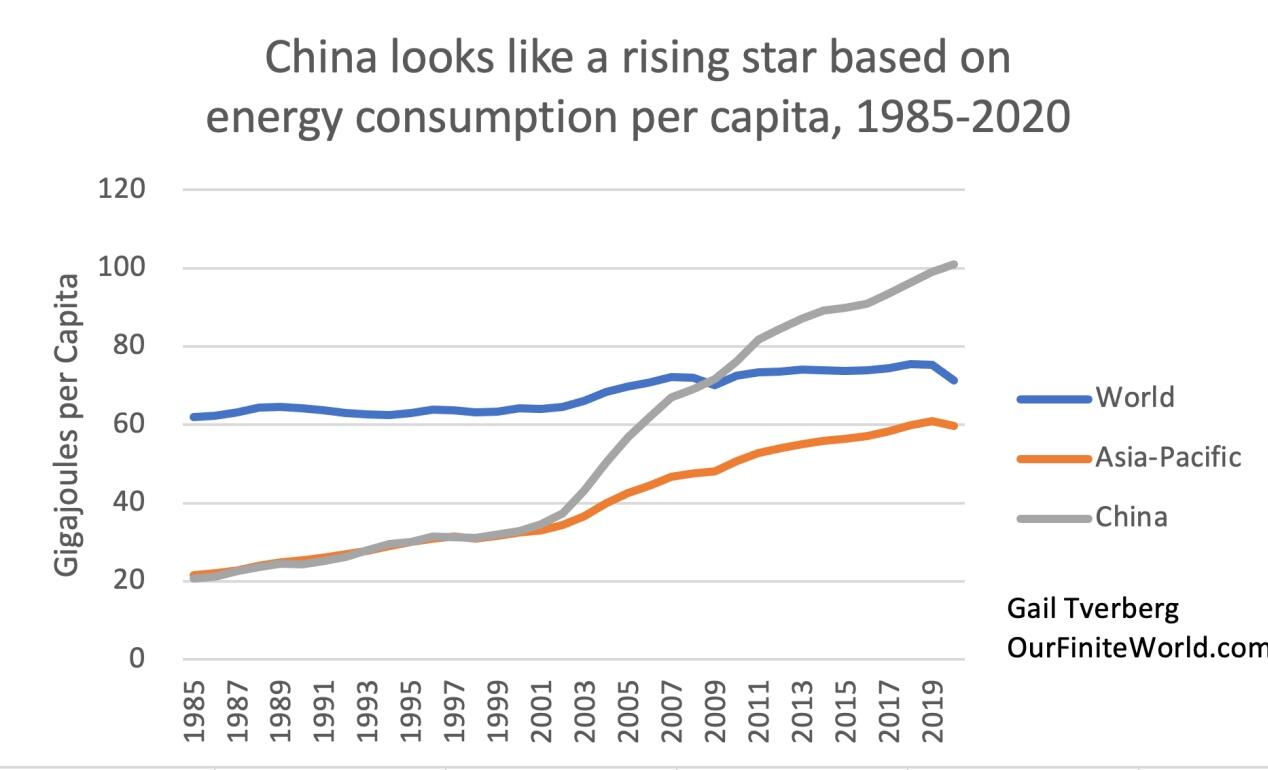

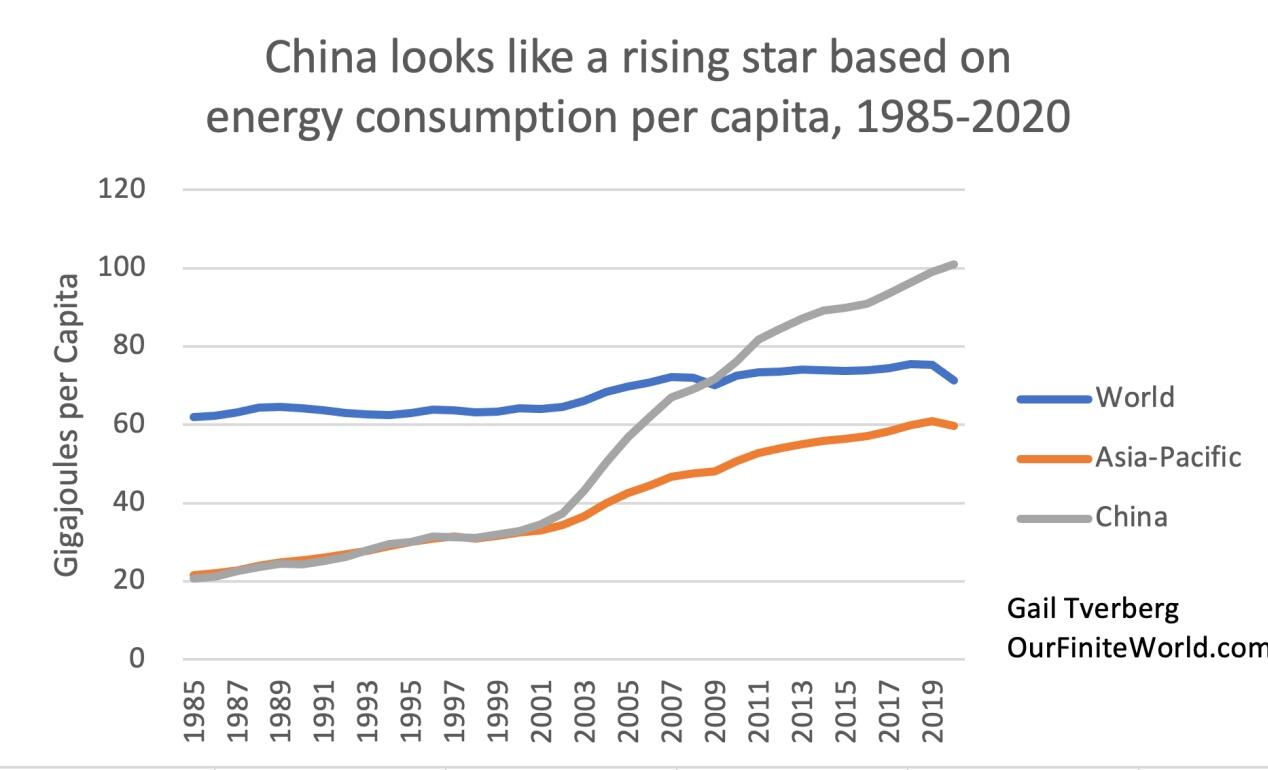

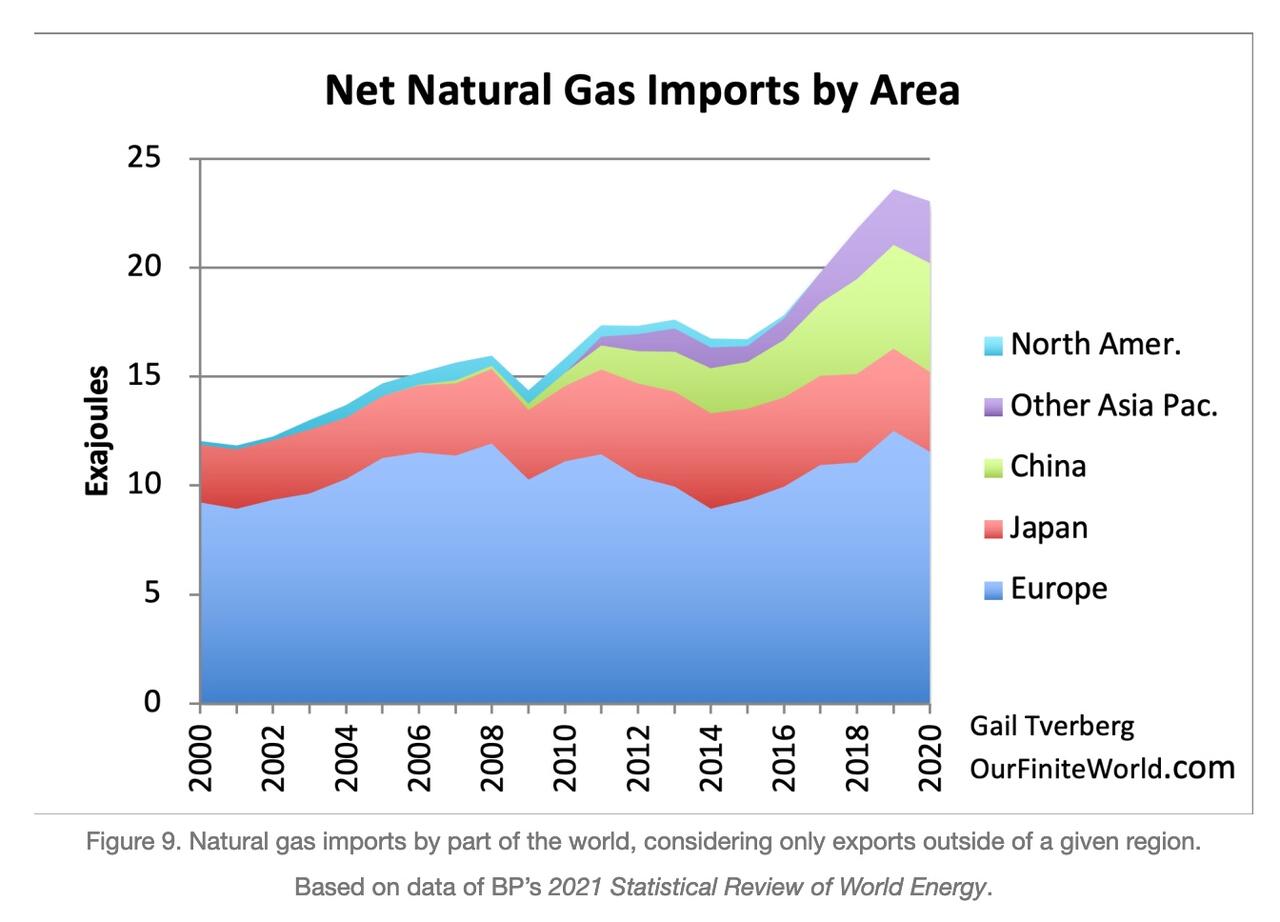

[6] Europe, in particular, cannot afford high oil prices. If interest rates are increased soon, this will make the problem even worse. China seems to have definite advantages as an economic partner.

TP: And herein lies the CRITICAL PIVOT. Even as China has become the WORLD’S MANUFACTURER and through its Belt and Road Initiative (BRI), begun COMMERCIALLY UNITING the Asian portion of Eurasia under its SUZERAINTY, Russia has likewise begun imposing its POLITICAL WILL on as many of its former Soviet republic/vassal states as possible.

The apparent CHINESE-RUSSIAN GRAND STRATEGY is to unite as much of Eurasia as they can into a single TRADING BLOCK, while STARVING THE WEST OF BOTH ENERGY AND VITAL GOODS AND RESOURCES, so as to END GLOBAL DOLLAR HEGEMONY and DEFEAT THE US AND ITS ALLIES ECONOMICALLY VIA BANKRUPTCY.

As per Terberg . . .

“In recent years, China’s consumption of energy products has been growing very rapidly. Perhaps, in the view of Russia, China can use high-priced fossil fuel better than other parts of the world.

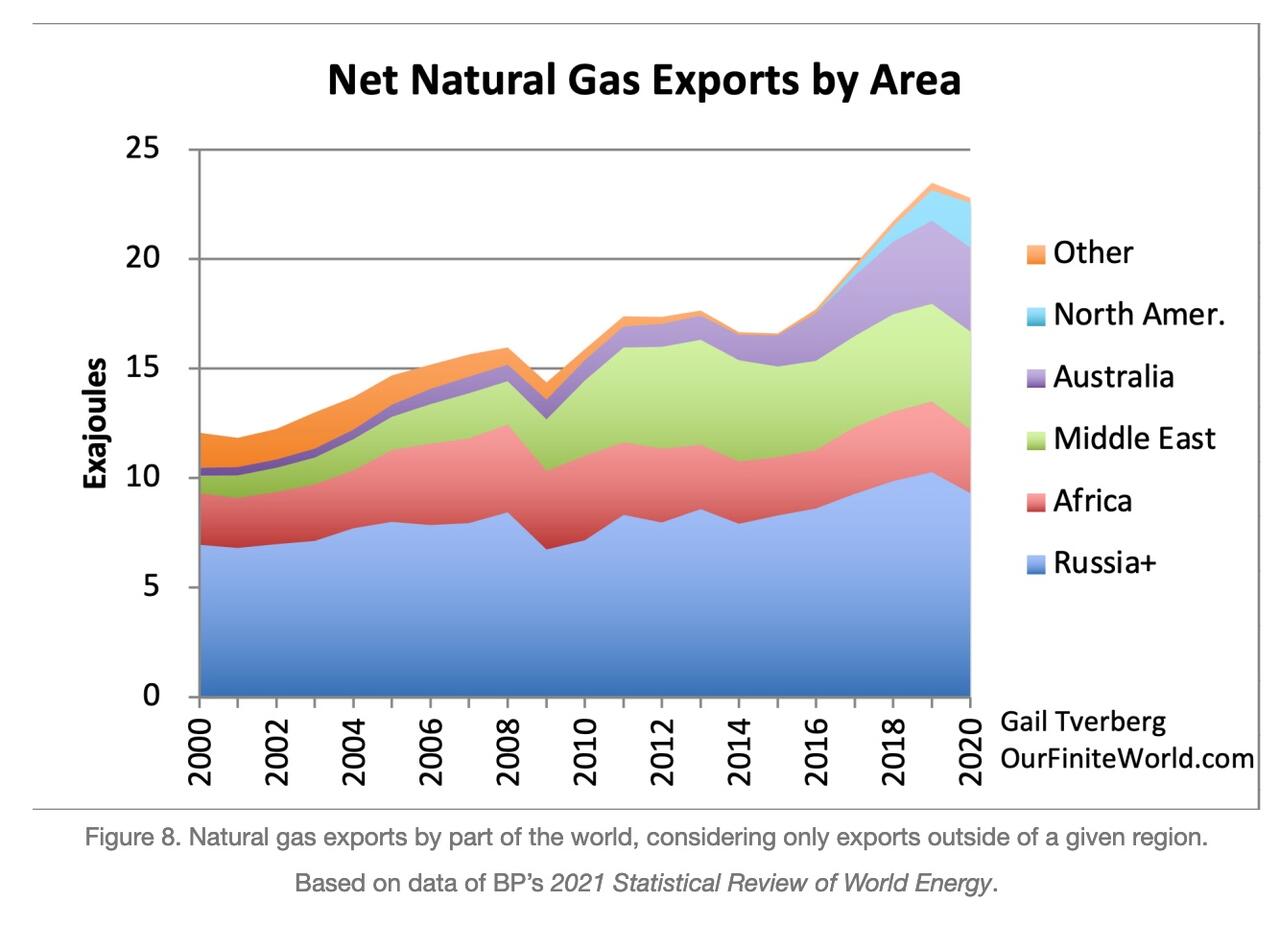

[7] Russia realized that the rest of the world is utterly dependent upon its fossil fuel exports. Because of this dependency, as well as the physics-based connection between the burning of fossil fuels and the making of finished goods and services, Russia holds huge power over the world economy.

TP: As Terberg explains:

- “The likely problem with fossil fuels has been hidden behind an imaginative, but false, narrative that our biggest problem is climate change caused primarily by fossil fuel extraction that can be expected to extend until at least 2100, unless positive steps are made to hold back this extraction.”

- “In this false narrative, all the world needs to do is to move to wind and solar for its energy needs.”

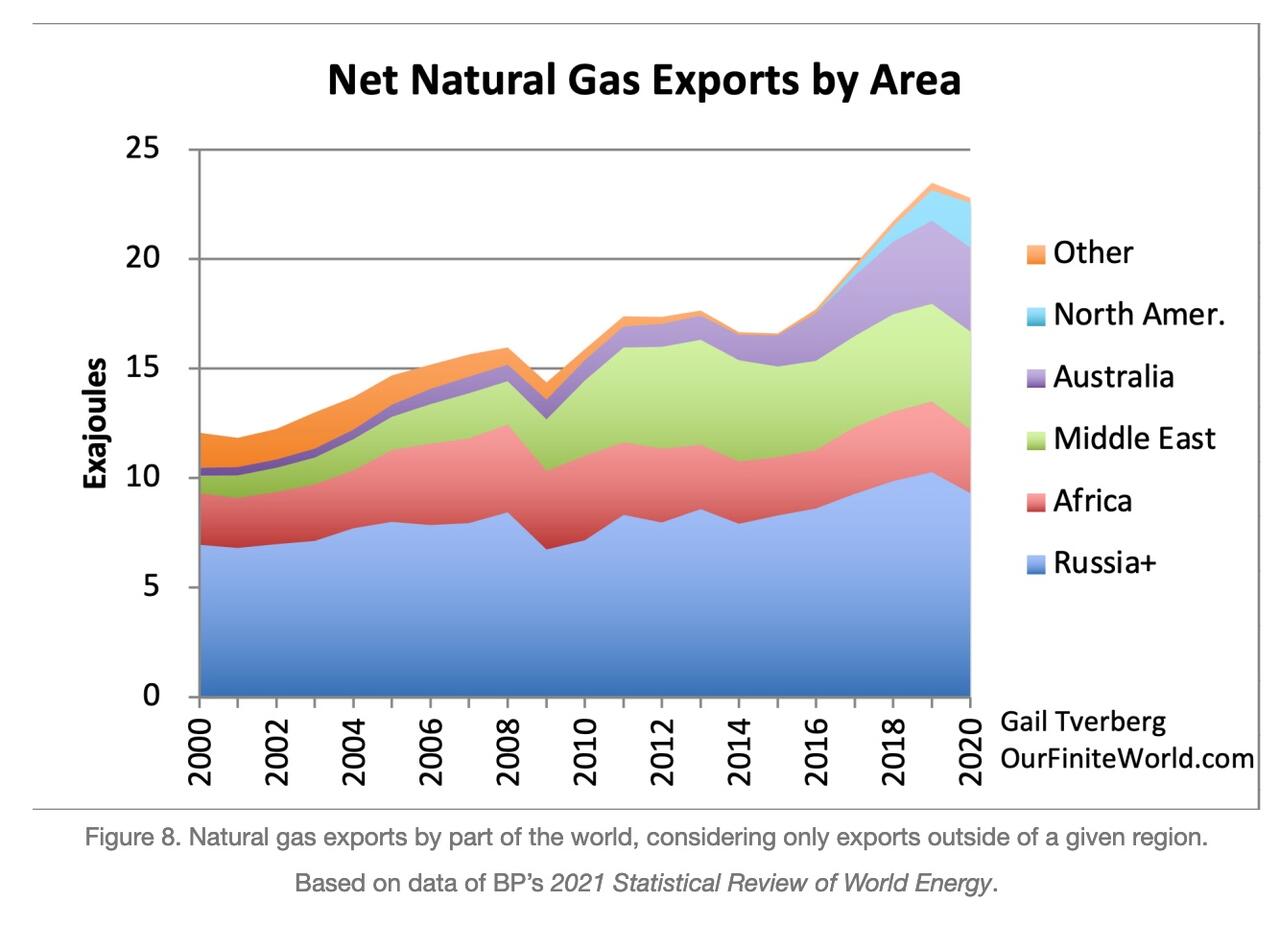

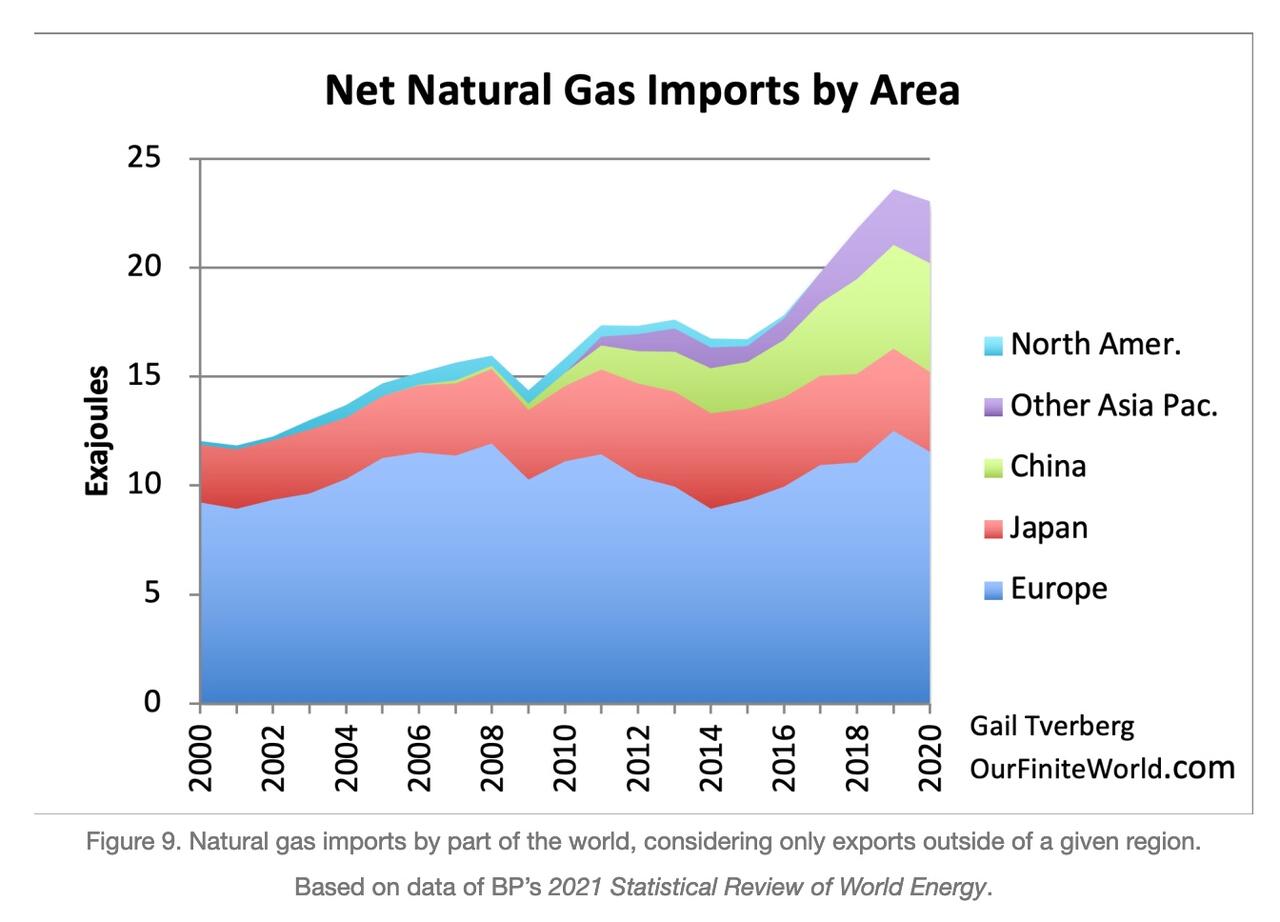

- “Few people in America and Europe realize that the world economy is entirely dependent upon Russia’s exports of oil, coal and natural gas.”

- “It is questionable whether North America can ramp up its total natural gas production in the future, given the depletion problems being experienced with respect to the extraction of oil and the associated natural gas from shale formations.”

TP: The dilemma facing Europe — and, by extension, the rest of the world — is BEYOND DAUNTING. As Tverberg points out . . .

“Without the natural gas exports of Russia and its close affiliates, there is no possibility of supplying adequate natural gas exports to the rest of the world. Diesel fuel, created by refining oil, is another energy product that is in critically short supply, especially in Europe.

[8] Russia’s attack on Ukraine seems to have been made for many reasons.

TP: I won’t list them here, but Tverberg covers them all.

[9] If higher energy prices cannot be achieved, there is a significant chance that the change in the world order will be in the direction of pushing the world economy toward collapse.

TP: Tverberg ends with TWO HAUNTING IRONIES that “quack” more like CATCH-22’s . . .

- We are living in a world today with shrinking energy resources per capita. We should be aware that we are reaching the limits of fossil fuels and other minerals that we can extract, unless we can somehow figure out a way to get the economy to tolerate higher prices.

- The Ukraine invasion may be a push in the direction of more serious energy problems, emerging primarily from the fact that other countries will want to punish Russia. Few people will realize that punishing Russia is a dangerous path; a serious concern is that today’s economy cannot continue in its current form without Russia’s fossil fuel exports.

TP: The US may now have lost control of the ULTIMATE GREAT GAME — OUR ONE-WORLD DREAM — and must now both REGROUP and RETHINK THINGS.

I’ve written elsewhere that the US must begin planning an INNOVATIVE, ROBUST AND INDEPENDENT WESTERN HEMISPHERIC ECONOMY. I believe THIS IS CRUCIAL. Because if Europe can’t get along without Russian energy AND/OR if Russia itself collapses, it will back to basics FOR US ALL.

Here’s the full essay:

Russia’s Attack on Ukraine Represents a Demand for a New World Order