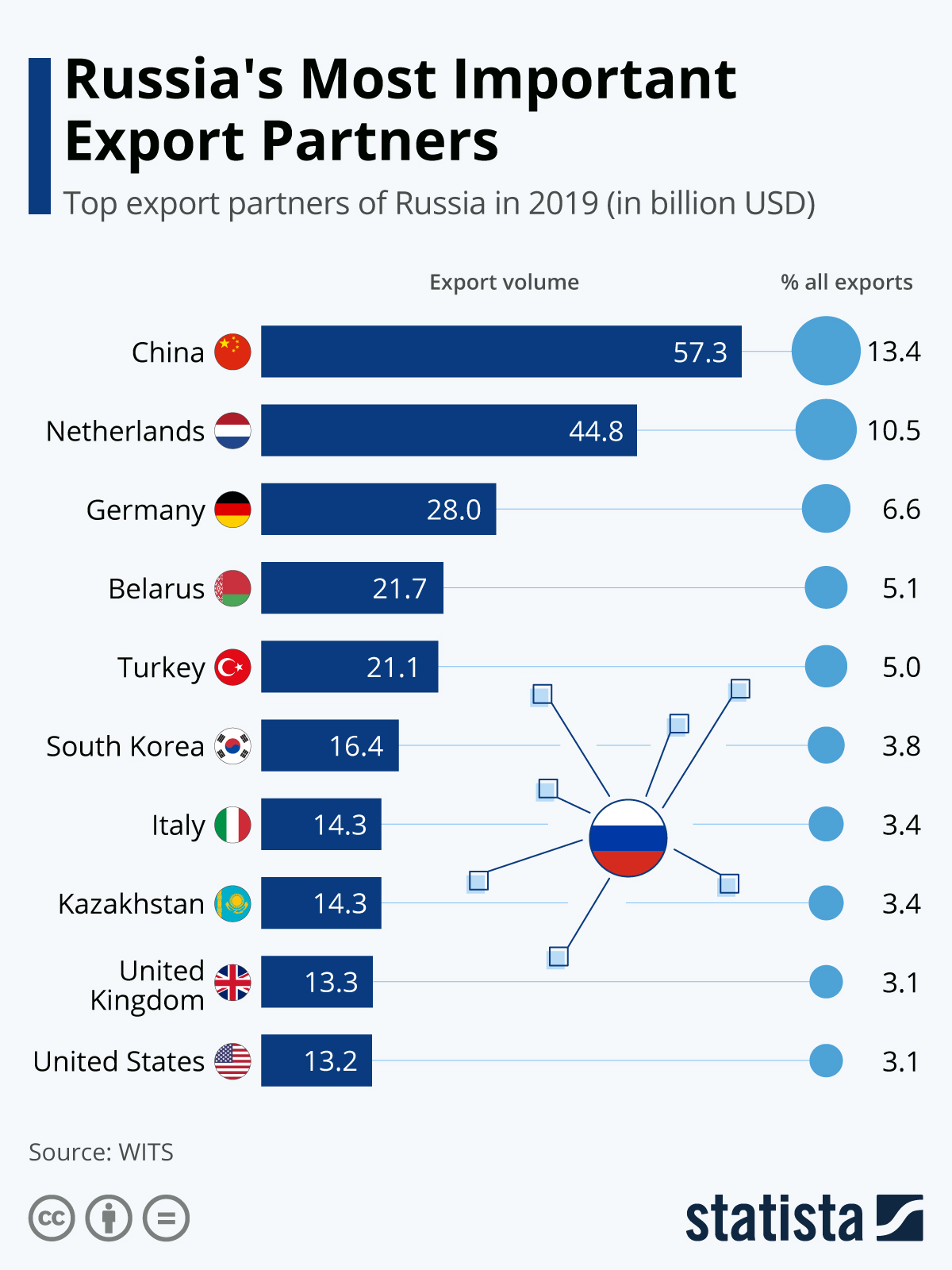

One note. The Netherlands is number two on this chart simply because much of what Russia exports flows THROUGH THE PORT OF ROTTERDAM to other countries.

One note. The Netherlands is number two on this chart simply because much of what Russia exports flows THROUGH THE PORT OF ROTTERDAM to other countries.

Try not going broke staying warm in Bulgaria.

Americans still don’t GET the extent of the energy crisis THAT’S FAST APPROACHING. But in Europe, THEY KNOW WHAT IT FEELS LIKE.

IT’S ALREADY THERE.

. . . Talks ALL THINGS Financial.

Few people in finance know as much about the current financial system as does Gordon Long. In this Ukraine-prompted Adam Taggart interview, Long exhaustively covers the waterfront: credit, central banks, hard assets, overnight lending, repos, sanctions, energy, zombie companies, financial repression, stocks, bonds, the works.

For a bird’s eye view of what’s happening now, this one is well worth your time.

. . . at Least for Now.

You can’t attempt a MAJOR ENERGY TRANSITION in a world as HAZARDOUS as ours without FACING SEVERE RISKS.

And, by its actions, Germany JUST CONCEDED THAT.

From Tsvetana Paraskova of OilPrice.com

Germany Goes Full Energy Policy Overhaul Amid Ukraine Crisis

Check this out:

“In a major change of course, Germany – which had argued until a few months ago that it is looking at the purely commercial benefits it would gain from Nord Stream 2 – is now not only putting the project on ice, but it is also supporting the construction of two terminals to import liquefied natural gas (LNG) and is not leaving any energy source – not even coal or nuclear – off the table.”

And this:

“No energy source is “taboo” in the new German energy strategy to move away from Russian gas dependence, said economy minister Robert Habeck, a member of the Green Party.”

Yes, you read that correctly. The quote is from a GREEN PARTY cabinet minister. And if he realizes that we’re still a LONG WAY FROM GREEN and still highly dependent on natural gas, nuclear and even coal during that UNCERTAIN INTERIM, IT’S TIME THAT OTHERS ACKNOWLEDGED IT.

INSTANT GREEN IS A FANTASY.

MUST-SEE interview with Walter Isaacson. Browder knows his subjects. Cold.

From Nikos Chrysoloras at Bloomberg:

I feel like it’s 1962 again, and Father Anselm is telling us he hopes we can squeeze in Algebra class before the missiles arrive.

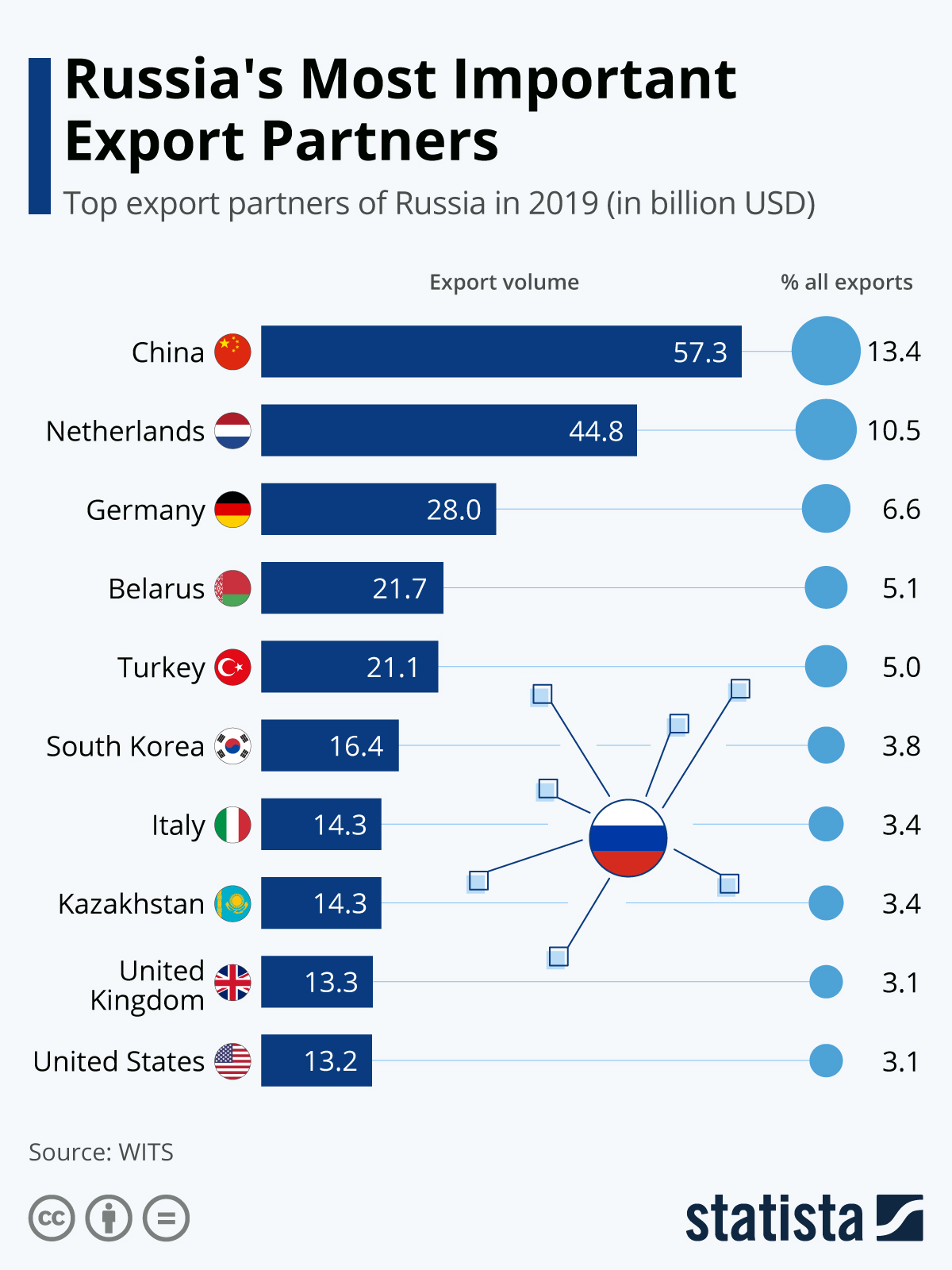

Some data worth noting from Michael Wilson, chief US equity strategist.

First, a little framework refresher:

Honestly? We know a lot more about the RUSSIAN INVASION UNKNOWN/UNKNOWN than the STRONG GROWTH UNKNOWN/UNKNOWN. Fact is, there’s NOTHING TO KNOW about strong growth. THERE ISN’T ANY.

AND NONE ON THE WAY.

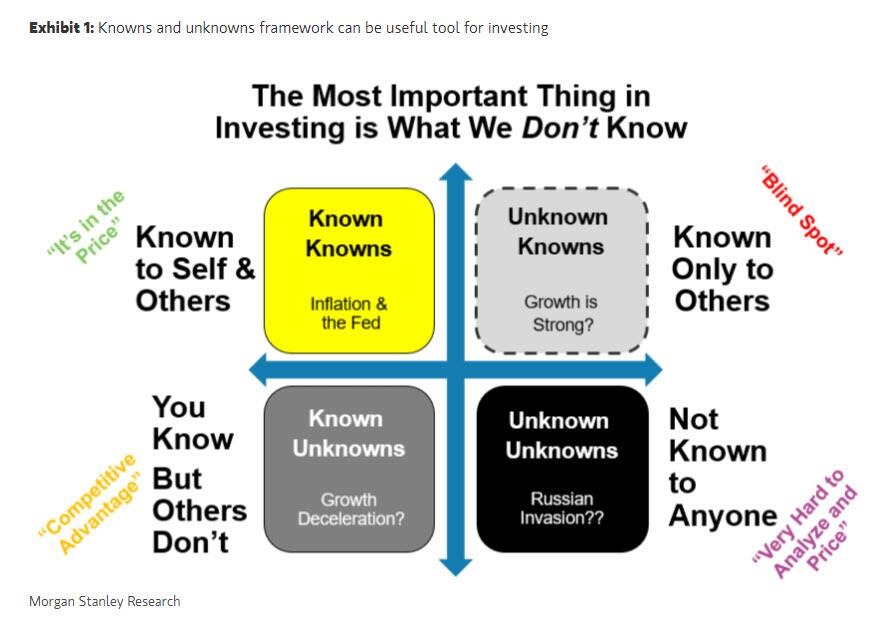

MS’s risky earnings charts:

Correct, plenty of NEGATIVE.

And this doesn’t look promising either:

MS’s conclusion:

The Russian invasion “simply adds another risk to the mix that’s unlikely to disappear quickly. In a world where valuations remain elevated and earnings risk is rising, last week’s tactical rally in equities will likely run out of momentum in March as the Fed begins to tighten in earnest and the earnings picture deteriorates.“

YES, WE’RE REAPING A KIND OF WHIRLWIND. SHORT-TERM, LONG-TERM, BOTH.

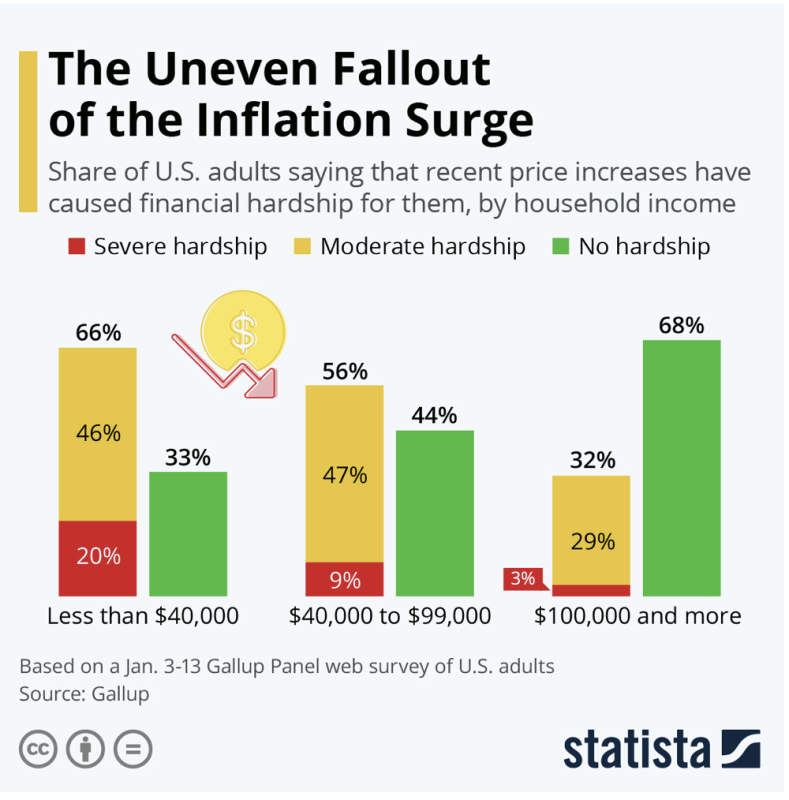

Those with less feel adversity more.

Resources are still the difference.

What most of us would expect.

. . . about A) GEOPOLITICS, B) ENERGY and C) EXACTLY WHERE THEY INTERSECT.

Excellent piece from Rupert Darwall via RealClearEngergy.org.

Standing Up to Putin Means Ditching Net-Zero

Some notable excerpts from the piece:

These are just HIGHLIGHTS. The guts of the piece contains CRITICAL ELEMENTS that connect the dots above.