Says who?

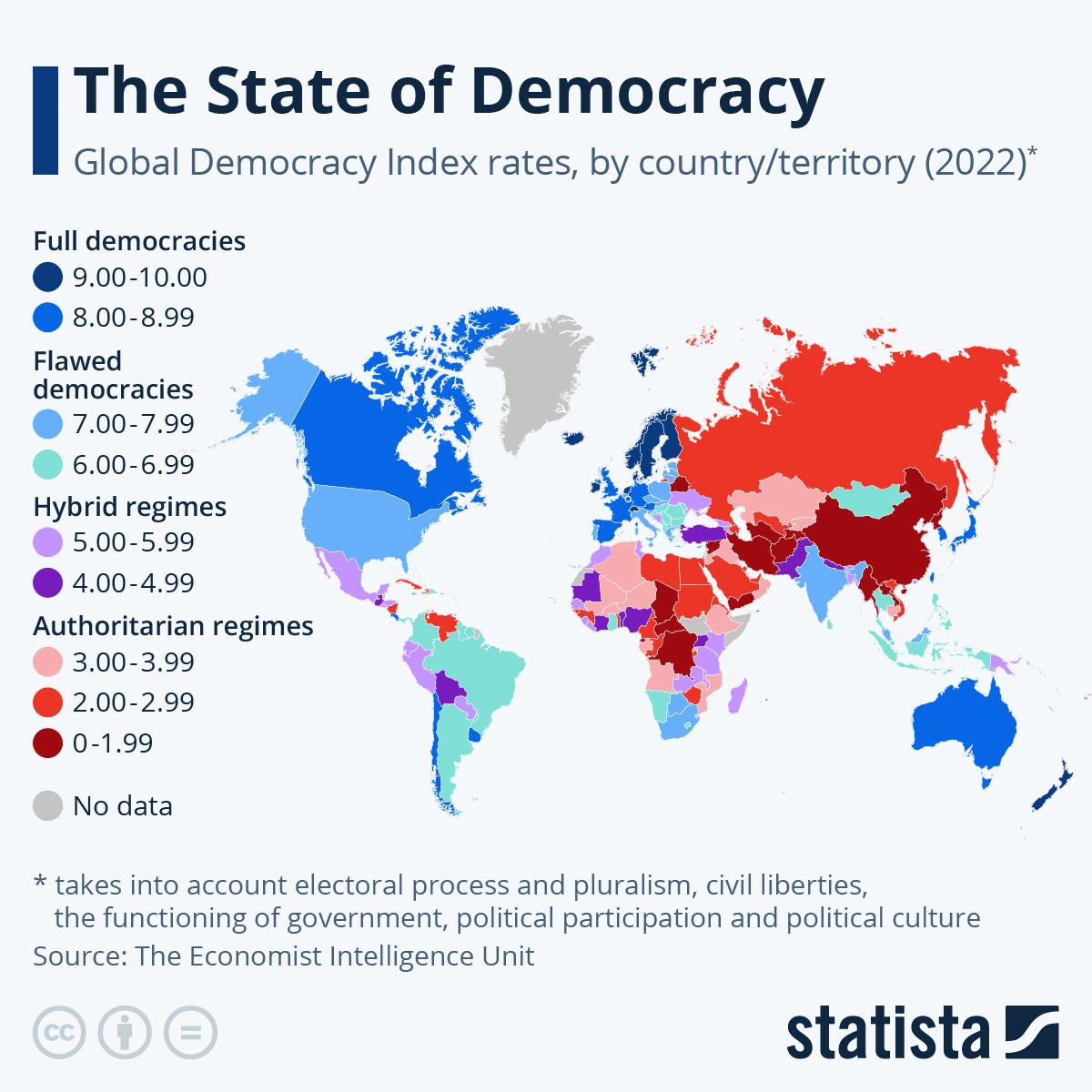

THE ECONOMIST.

THAT’S who.

My, how the worm do turn.

Anyone see where we stand in the BANANA REPUBLIC INDEX?

I take it WE’RE MOVING UP THERE.

Says who?

THE ECONOMIST.

THAT’S who.

My, how the worm do turn.

Anyone see where we stand in the BANANA REPUBLIC INDEX?

I take it WE’RE MOVING UP THERE.

. . . founder and lead singer of iconic late-60’s British band, Procul Harum

I loved the entire band actually, especially the lineup that produced Procul Harum, Shine on Brightly and A Salty Dog — Brooker, Mathew Fisher, Robin Trower, David Knights and B.J. Wilson.

And, of course, lyricist, Keith Reed, without whom Procul Harum would have been — NO DOUBT — a paler shade of ENIGMATIC.

My favorite track:

The earliest live version:

With the Danish National Concert Orchestra in 2006.

Great stuff.

And the capper . . .

SHINE ON, GARY!

Before 1998, the US produced half the world’s magnesium. China now produces 85% of it.

Have we NOT seen this movie?

From Doomberg:

But, of course, this is DANGEROUS.

“China’s response to the current energy crisis is leading to a supply shock in the solar industry, reversing years of cost improvements. It’s a similar story with magnesium, only the potential impact on the global economy is substantially higher . . .

“Due to the Chinese Government’s effort to curb domestic power consumption, supply of magnesium originating from China has either been halted or reduced drastically since September 2021, resulting in an international supply crisis of unprecedented magnitude.

“With the European Union almost totally dependent on China (at 95%) for its magnesium supply needs, the European aluminium, iron and steel producing and using industries together with their raw materials suppliers are particularly impacted, with far-reaching ramifications on entire European Union value chains, including key end-use sectors such as automotive, construction and packaging.”

And here’s the DEEPER PROBLEM:

“Energy is the lifeblood at the center of the economy, and so it is only natural that the explosions we are observing in the price of energy in Europe and Asia will make their way outward through the many value chains of manufacturing. Since the production of magnesium is so energy intense, its price chart mirrors that of liquified natural gas, fertilizer, polysilicon, and the many others crossing our terminal today. These cost pressures will soon be passed on to chemicals, food, solar panels, and cars, adding further fuel to the inflationary fires igniting across the globe.”

SO, DON’T NECESSARILY COUNT ON INFLATION BEING TRANSITORY, FOLKS, BECAUSE WE’RE NOT TALKING ABOUT PURELY TRANSITORY FINANCIAL DYNAMICS BUT RATHER STRUCTURAL ECONOMIC ONES.

Plus purely stupid plus awfully COLD.

The tweet below is from last Christmas Eve. I’m posting it now as a reminder of the kind of simplistic thinking that has taken hold in STAUNCHLY LIBERAL REGIONS regarding the need to LIQUIDATE at lightspeed the use of all FOSSIL and NUCLEAR.

THEY NEED TO FOLLOW “THE SCIENCE.”

Another example of how we’re no longer a productive country.

We’ve moved from producing to self-cannibalizing using INFLAMMATORY GOSSIP as our PRINCIPLE MEDIUM.

And what do we net for our pains?

MORE DEBT.

That’s right. We’re wasting money wasting words.

Oh, don’t you just love stock buybacks? They’re right up there with OFF BALANCE SHEET ACCOUNTING.

Why do we make financial rules only to break them with different financial rules?

BECAUSE WE’VE HOPELESSLY QUEERED THE SYSTEM.

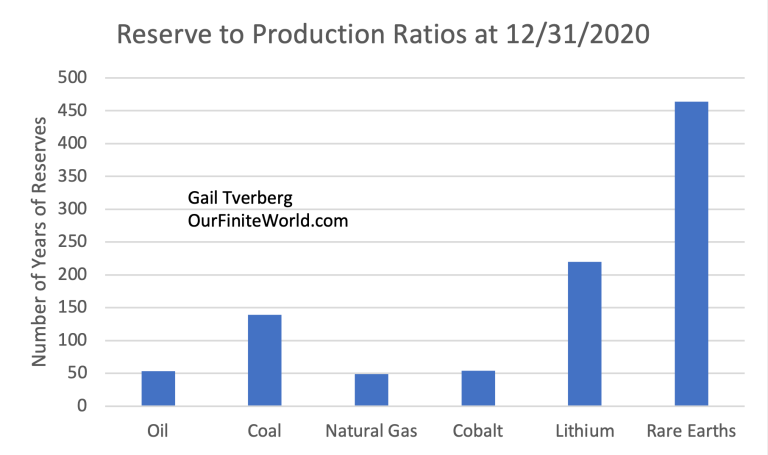

As opposed to our “kicking coal.”

From Oilprice.com

Banks Have Spent $1.5 Trillion on Coal since 2019

From the piece:

COAL WILL BE USED WHENEVER AND WHEREVER IT’S THE PREFERRED FUEL SOURCE. IT’S THAT SIMPLE. AFTER ALL, INDIA AND CHINA AREN’T SHUTTING DOWN THEIR ECONOMIES. NOT EVEN FOR GRETA.

Here are paragraphs one through three — plus an INSERT OF MINE — as per this one.

“’It’s important to recognize that net zero demands a transformation of the entire economy.’ – Larry Fink (emphasis added)”

WHAT DO YOU MEAN, LARRY? NO SWITCHING ON LIGHTS OR TURNING THE KEYS TO OUR COMBUSTION ENGINE CARS? BECAUSE THAT’S WHAT NET ZERO WOULD TAKE.

DOOMBERG:

“We are on the cusp of a significant mass starvation event of our own making. Soon, tens of millions of the world’s most impoverished people will die from an inability to feed themselves, while many of those comfortably getting by now – especially in the Western World – are in for a shock.

“The leaders who put us in this position are doubling down on their misguided energy policies and will continue to do so until they are overthrown. I doubt they will go peacefully. Between now and then, they will use all manner of surveillance tools to spread Orwellian propaganda, misdirect blame, and crush dissent. Leading technology companies will greedily facilitate this modern incarnation of the Great Leap Forward, imaginary utopian ends justifying all manner of grotesque means.”

AND — JUST AS TIMELY AS IT WAS LAST SPRING — HERE’S THE REST OF IT.

Wow, have we ever taken a WRONG TURN.

This is from last spring. But it’s just as relevant today. Especially with what’s going on in Ukraine.

And here’s just a nibble:

“Assume you believe, like I do, that gold is the only real money. How much gold buys you a barrel of oil? Today, it is a shockingly low amount – only 0.036 ounces. Yes, you read that correctly. Roughly 1 gram of gold does the trick. When oil was trading at $145 in mid-2008, its price in gold was 0.15 ounces. With gold now trading at $1,900 an ounce, that works out to about $285 a barrel oil.”

OH, YEAH.

And it’s not because that ship has SAILED.

Actually, it’s NEVER BEEN LAUNCHED and MAY NEVER BE BUILT. But even if one should somehow roll out, it may not be sufficiently seaworthy.

And I wouldn’t pin my hopes on an ARK.

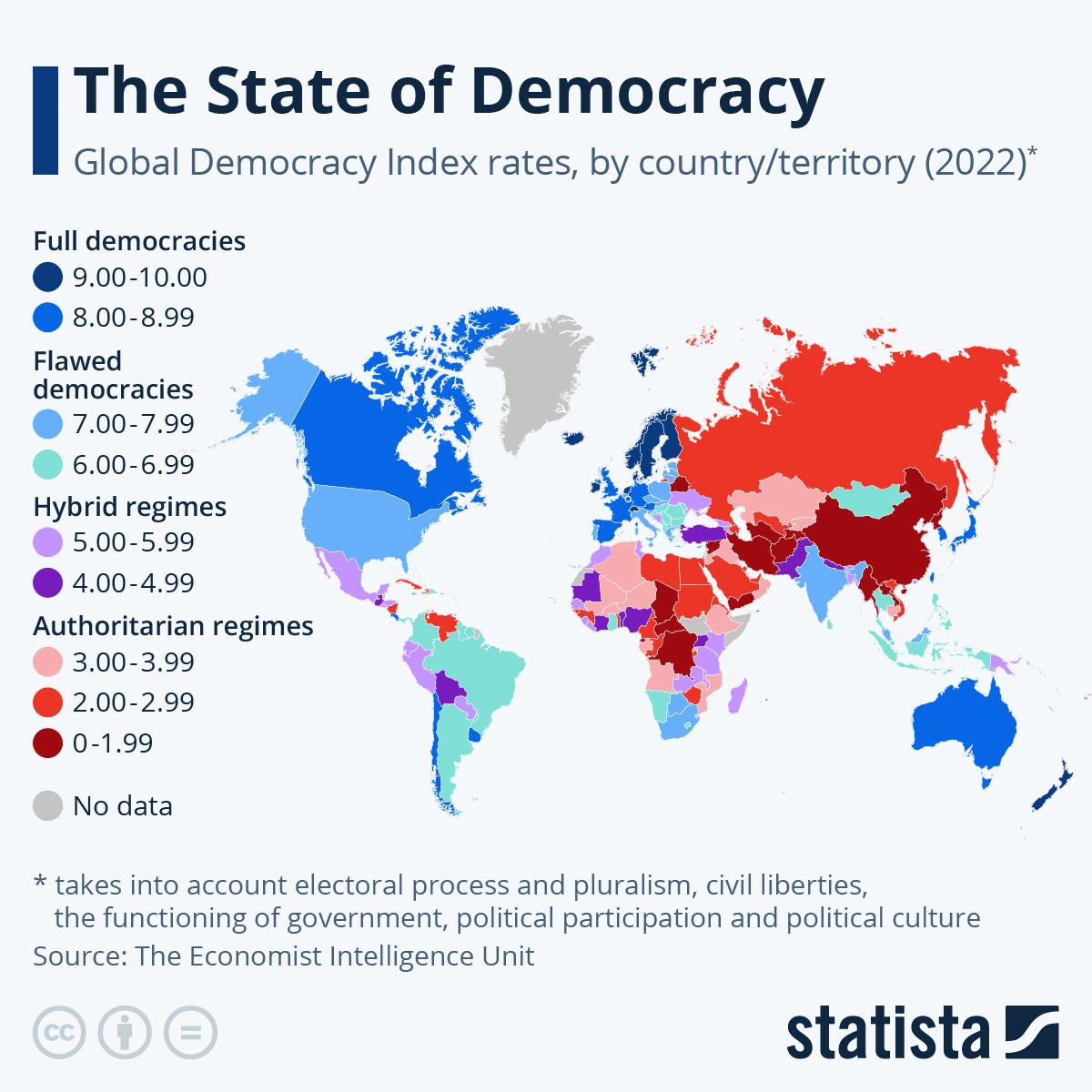

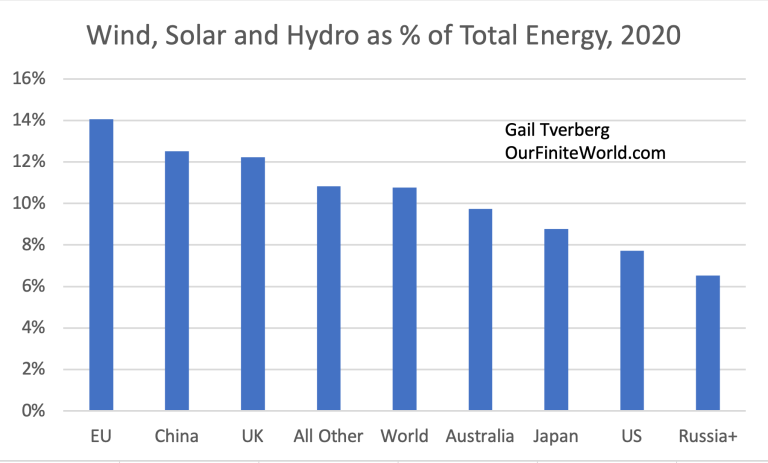

From Gail Tverberg:

Limits to Green Energy Are Becoming Much Clearer

Even as the war against carbon use continues . . . and even as the panic and zealotry ratchet up . . . the reality suggests that we’re going ALL IN on a PIPEDREAM.

Tverberg’s argument and I’m quoting:

“In order to produce more fossil fuels or more minerals of any kind, preparation must be started years in advance. New oil wells must be built in suitable locations; new mines for copper or lithium or rare earth minerals must be built; workers must be trained for all of these areas. High prices for many commodities can be a sign of temporarily high demand, or it can be a sign that something is seriously wrong with the system. There is no way the system can ramp up needed production in a huge number of areas at once. Supply lines will break. Recession is likely to set in.”

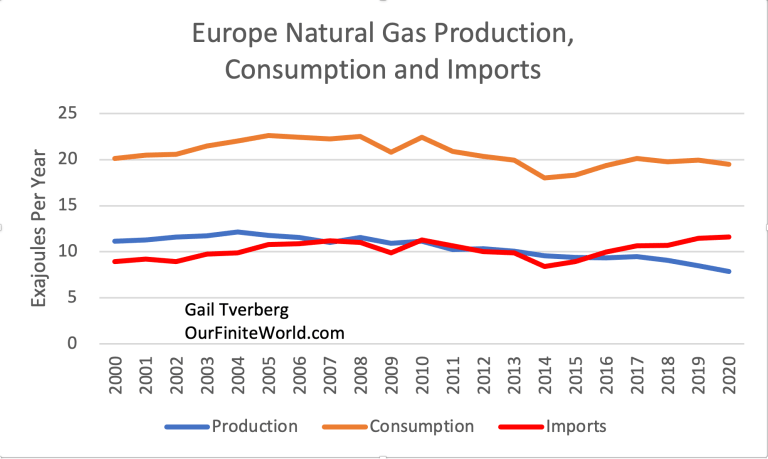

The situation in Europe looks PARTICULARLY precarious:

[7] Conclusion. Modelers and leaders everywhere have had a basic misunderstanding of how the economy operates and what limits we are up against. This misunderstanding has allowed scientists to put together models that are far from the situation we are actually facing.

THERE ARE NO IMMACULATE FIXES HERE. NO SOFT LANDINGS OR ESCAPE HATCHES.

AS USUAL, WE WILL MUDDLE THROUGH TAKING CASUALTIES AND SURRENDERING GROUND.

IT’S REALITY, NOT SOMETHING PRESENTED ON STORYBOARDS.

From Michael Every and the team at Rabobank.

If you think that this post is long, you should see the length of the document from which I extracted the data compiled here. Still, I had to do it as the information was simply too RICH.

THREE WAR COST SCENARIOS

Assumption 1: Global Trade Flows

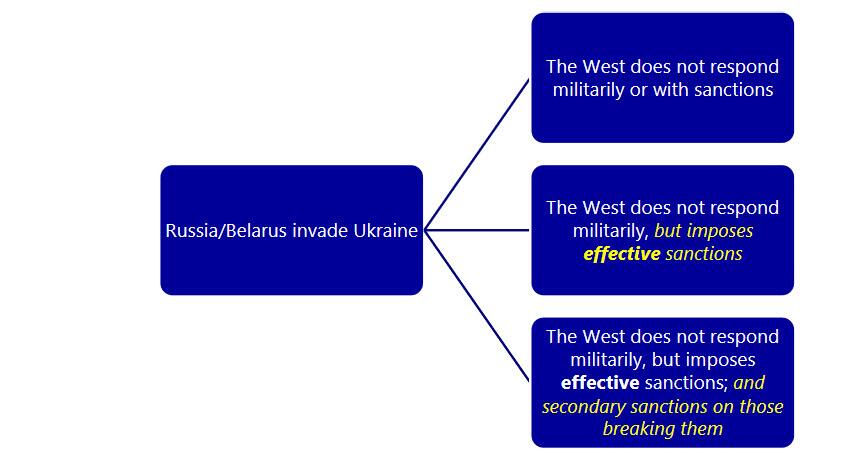

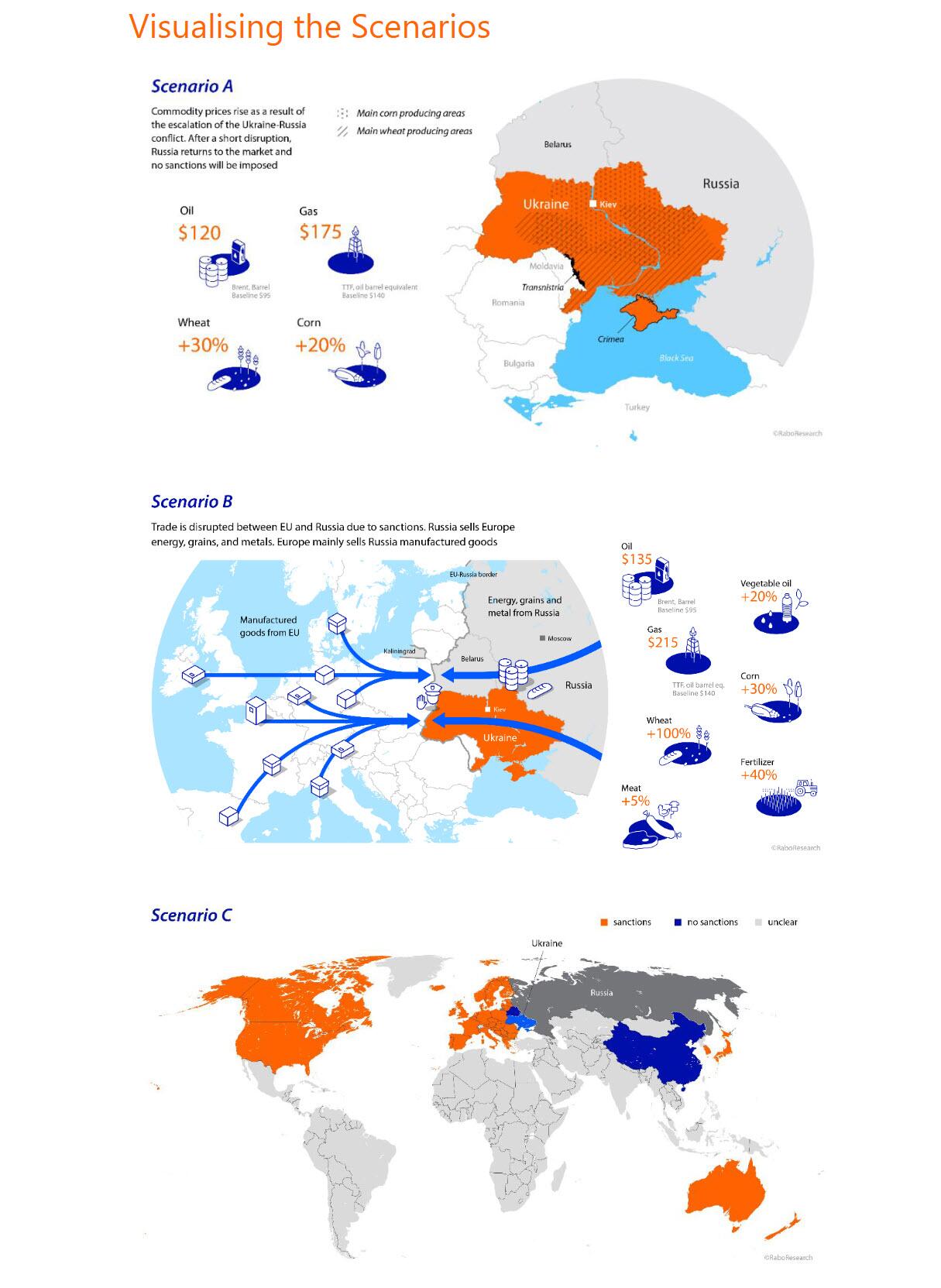

“Scenario A, war, disrupts global trade for a maximum of six months. We assume significant drops in EU-Russia trade flows in particular.

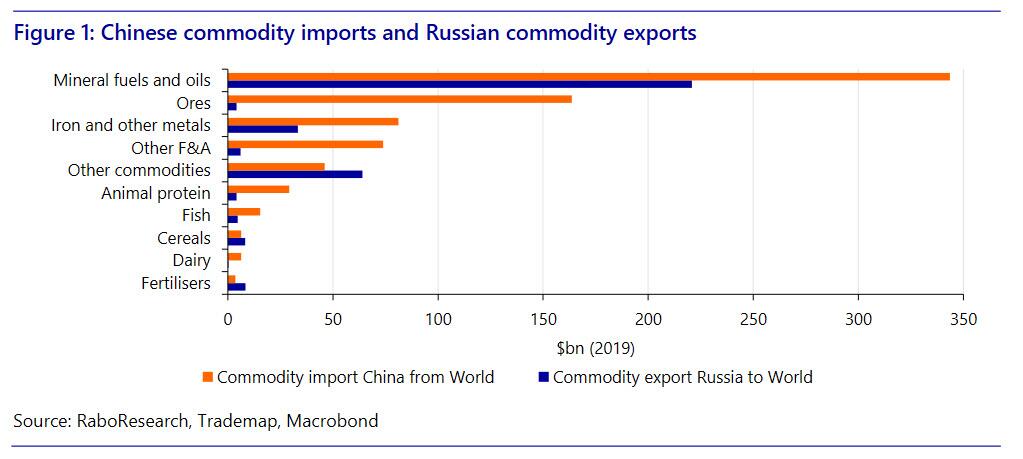

“Scenario B, war and effective sanctions, assumes the same, and that sanctions are imposed on Russia, occupied Ukraine, and Belarus by the US, EU, Australia, New Zealand, Japan, and Korea, altering global trade patterns. Yet some countries will try to evade such sanctions: China has stated it will work with Russia to do so. We therefore assume that $100bn in commodity trade previously seen between sanctioning countries and Russia is rerouted to China at a discount while other countries pay higher prices.

“In scenario C, we assume the West also imposes effective secondary sanctions on China and other non-compliant economies.”

Assumption 2: Risk Premia

“In scenario A, war, we adopt a relatively small overall rise in the global investment risk premium, comparable to the rise seen after the annexation of Crimea in 2014.

“In scenario B, war and effective sanctions, we increase the global investment risk premium to match the increase seen during the second Gulf War in 2003.”

Scenario C is unquantifiable.

Assumption 3: Oil and Natural Gas Prices

Oil

“Scenario A, war, would result in Brent spiking as hoarding, increased transit costs, and the geopolitical risk premium spikes. The last major oil supply disruption to Europe was during the 2011 Libyan civil war, when its oil exports collapsed due to infighting: as Libyan oil production fell from 1.5mb/d to zero, Brent prices spiked from $90 to more than $125 over four months.

“Scenario B, war and effective sanctions, would see oil at $135 and higher for far longer.”

Scenario C is unquantifiable.

Natural Gas

In scenario A, “we assume $175 per barrel of oil equivalent.”

In scenario B, we assume $215, “and for far longer.”

Scenario C is unquantifiable.

Assumption 4: Food Prices

“War would have a major impact on grains, vegetable oils, and fertilizers.

“Scenario A, war, would stop Ukrainian wheat, barley, and corn exports. With very tight global markets, this would drive prices up even if 2/3 of the season’s wheat and barley and 1/3 of the corn crop has already been exported. We expect a 30% rise in wheat and 20% in corn prices.

“Scenario B, war and effective sanctions, would be worse. Russian wheat and barley have also been 2/3 exported this season, but Russia and Ukraine account for 30% of world wheat exports, which would drive global prices up 30% if removed.

“We assume a 20% rise in vegetable oil prices in scenario B.

“We assume fertilizer prices rising 20% in scenario A and 40% in scenario B. However, China would again be insulated in scenario B if it can trade with Russia.”

Unquantifiable Scenario C

“Scenario C means war, the West imposing effective sanctions on Belarus/Russia, and then effective secondary sanctions on China other economies that deal with Russia.

“Crucially, this would have such a disruptive effect on global trade flows that macroeconomic models cannot capture it: no model of the globalized international economy today can describe its political-economy bifurcation closer towards that which prevailed during the Cold War.

“Markets are unprepared for such outcomes . . . .”

The Macroeconomic Impact

Inflation

“Scenario A, war, would see a significant upward revision to y/y CPI inflation in 2022, ranging from 0.6 – 1.6ppts, and then flat to -0.7ppts downward revisions in 2023. This would once have been considered a major inflation shock – but against the present backdrop look mild or a continuation of the recent trend, which speaks to the scale of present inflation pressures.

“Scenario B, war and effective sanctions, would see upward revisions to y/y CPI inflation in 2022, ranging from 1.3 – to 3.5ppts, and then a further 1.4 – 5.9ppts in 2023. That is a major continuation of our current inflation shock. “

Scenario C is unquantifiable.

GDP Growth

“Scenario A, war, sees lower private consumption and investment and so downwards revisions to 2022 and 2023 GDP growth relative to our base scenario. In the dollar-bloc these effects are moderate, with the US seeing growth 0.2ppts lower in 2022 and essentially unchanged in 2023.

“Scenario B, war and effective sanctions, is more dramatic. US growth is 0.4ppts and 0.6ppts lower in 2022 and 2023, and the rest of the dollar bloc see growth 0.2-0.3ppts lower in 2022 and 0.2-0.6ppts lower in 2023.”

Scenario C is unquantifiable.

War Costs per Capita per Country

Wealth Effects

“Scenario A, war, suggests risks of an equity market correction, a 10% decline from present levels assuming this is not yet fully priced in (which we believe is the case).

“Scenario B, war and effective sanctions, suggests risks of an equity bear market, a 20% decline from present levels, assuming this is not yet fully priced in (which we believe is the case).”

Scenario C is unquantifiable.

High Risk/Reward for Russia: and the World!

“Scenario A, war, shows the Russian economy actually *benefits*. Shockingly, our model shows the average Russian would be $951 better off (in constant PPP dollars) if they win the war, and this is not including control of Ukraine’s fertile farmlands, or unquantifiable psychological, geopolitical, or geostrategic benefits.

“Scenario B, war and effective sanctions, however, would force Russian GDP per capita down a massive 5.2%, or $1,440. On one level, the risk/reward is clearly slanted towards Russia not acting,… if economics is a guide to geopolitical behavior. Yet only if we see *effective* sanctions! Yet these may prove hard to achieve.”

Scenario C is unquantifiable.

BOTTOM LINE:

THE ANALYSTS AT RABOBANK ARE CLEVER, REALISITIC AND OFTEN ON TARGET. ACCORDINGLY, THERE’S A LOT HERE THAT MAKES INTUITIVE SENSE. LET’S HOPE THAT THE BIDEN-PUTIN SUMMIT THAT MACRON HAS APPARENTLY BROKERED TAKES PLACE AND BEARS FRUIT.

WE REALLY DON’T NEED THIS WAR.