I mean, WHAT IS THERE TO ADD?

Category: Uncategorized

Albert Edwards’ Four Surprises

Edwards being Edwards.

For those keeping score at home, surprises one through four:

- Equity markets will fall sharply, startling investors.

- If a bear market occurs, the Powell put will survive.

- CPI inflation will fall back below 2%.

- China will start printing again, leading to a “rapid renminbi devaluation.”

But are we coming to the end of an EPOCH?

Deutsche Bank’s Top Themes for 2021: Part 1

And loans to Donald Trump and money laundering for Russian oligarchs — HEY ISN’T THAT THE SAME THING? — aren’t among them.

Here are the first 5 of 10:

- An overheating economy

- COVID optimism

- A hypersonic labor market and inflation

- Corporate focus on asset efficiency

- Inventory glut

Some interesting themes to be sure, yet DB’s analysis strikes me as narrow.

But then, how do you factor in RANDOMNESS . . .

UNDER ANY SCENARIO?

Musk Isn’t Woke

No, not by a long shot. To him, WOKENESS is a “mind virus.”

And this:

Or as I see it, to be WOKE is to SEEK POWER by UNDERMINING THE MORAL CREDIBILITY of those who currently HOLD POWER.

Yang & McWhorter

An excellent exchange between a former Democratic primary candidate for President and a linguistics professor who’s also a registered Democrat.

But these are HETERODOX Democrats — not ORTHODOX PROGRESSIVE LIBERALS who follow CANONICAL BELIEFS.

No, this is the discerning, more questioning, COMMON SENSE brand of Democrat. And this clip explains just why.

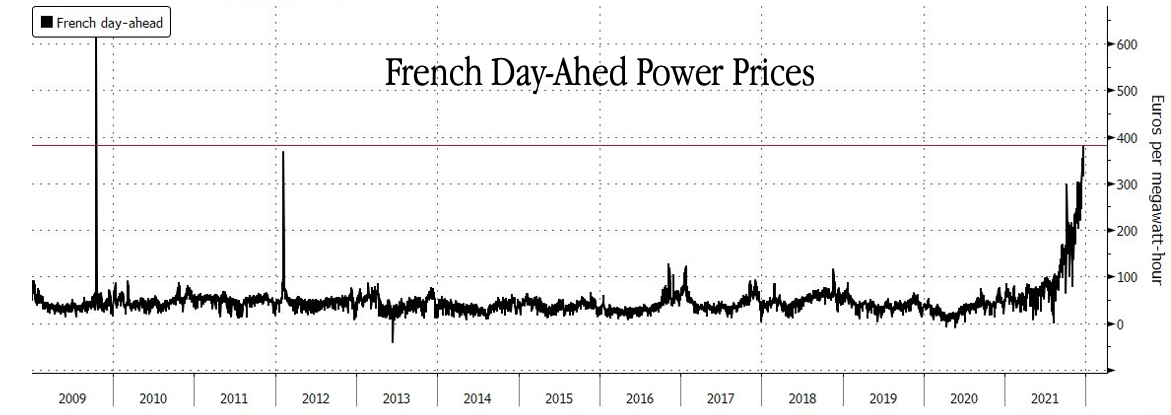

Europe’s Energy Crisis

Yes, energy prices are out of control in Europe. But, hey, let’s just decarbonize as fast as we can to see if we can drive them HIGHER!

And JUST IN TIME FOR THE HOLIDAYS.

From Bloomberg’s Chief Energy Correspondent:

That’s right. JUST CHUCK THE BUSINESS and resell POWER on the spot-market. An INSANE OUTCOME, yet GOOD BUSINESS!

In France, there are also nuclear power plant safety issues at several locations. Gee, good timing, nuke plants!

Overall, European natural gas prices have surged by more than 600%.

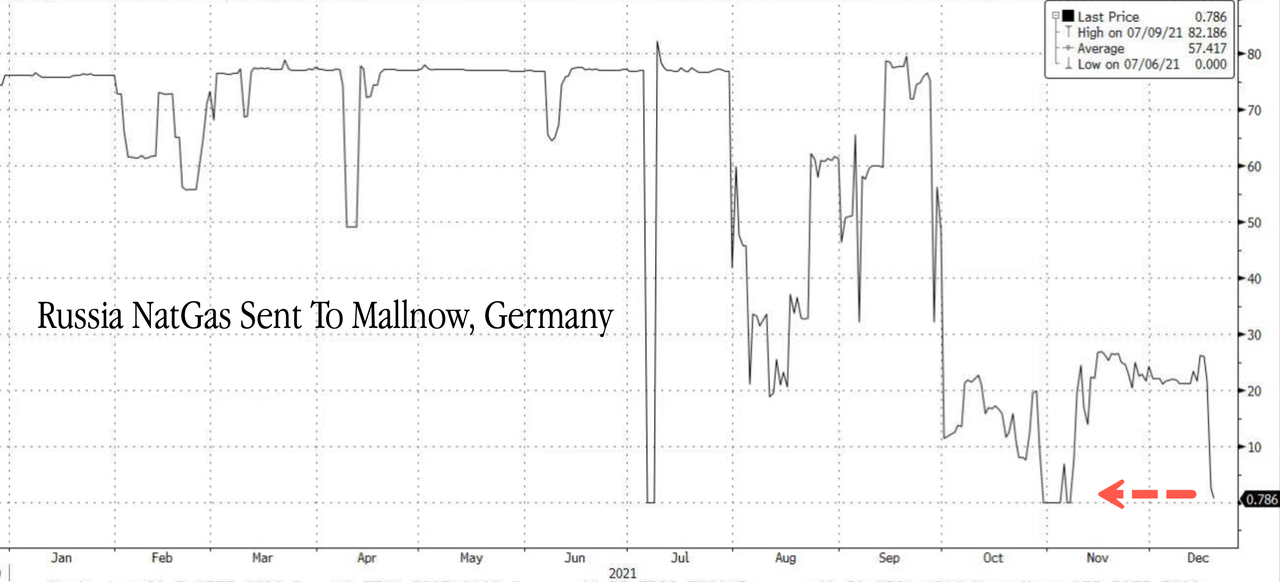

Supply constraints have persisted with continental gas storage tanks only 60% filled. In Germany, the “Mallnow compressor station collapsed over the weekend.”

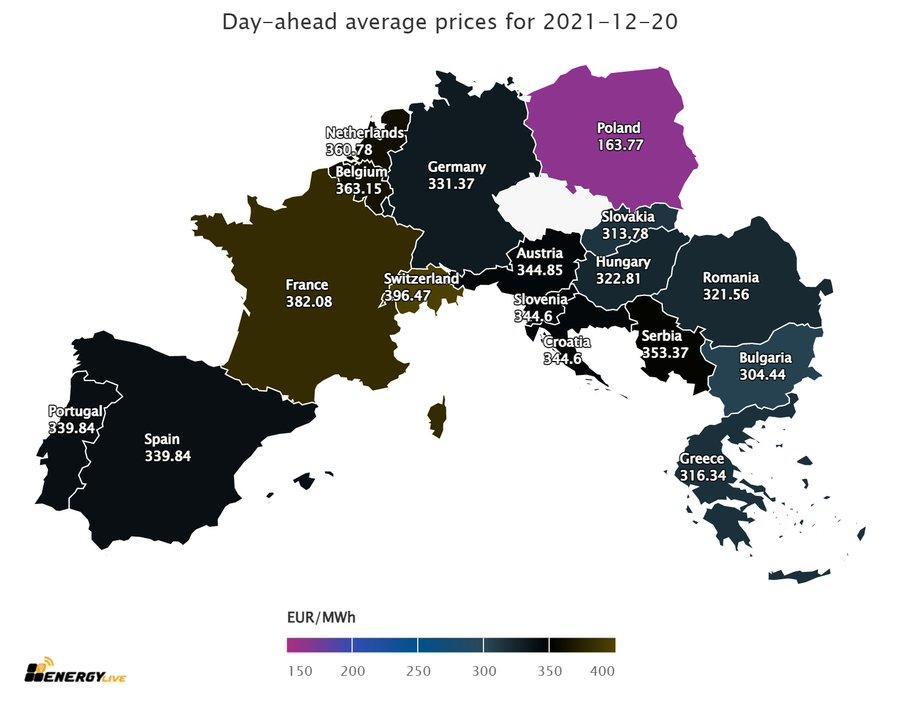

The short-term European electricity market is a “shambles.” Except for Poland and Scandinavia, “all Europe is above 300 Euros per MWh” with France and Switzerland nearing 400 Euros.

Meanwhile, across the pond, there’s been much milder weather which has greatly DEPRESSED gas prices. Let’s hope this continues!

Bottom line:

“Europe’s energy crisis worsens and risks sparking discontent among many Europeans. How long until politicians order utilities to implement price caps on power rates? If politicians want to stay in power, they might also have to subsidize people’s power bills as energy inflation runs wild.”

PREVIEWS OF COMING ATTRACTIONS.

The Green Economy = Magical Thinking

A report from the conservative thinktank, the Manhattan Institute.

When it comes to energy, conservatives appear to GET IT RIGHT.

The “New Energy Economy”: An Exercise in Magical Thinking

What follows is a summary — plus samples — of what’s covered. And I’m quoting. All underscoring is mine.

Introduction

“To be sure, history shows that grand energy transitions are possible. The key question today is whether the world is on the cusp of another.

“The short answer is no. There are two core flaws with the thesis that the world can soon abandon hydrocarbons. The first: physics realities do not allow energy domains to undergo the kind of revolutionary change experienced on the digital frontiers. The second: no fundamentally new energy technology has been discovered or invented in nearly a century — certainly, nothing analogous to the invention of the transistor or the Internet.”

Moonshot Policies and the Challenges of Scale

“To completely replace hydrocarbons over the next 20 years, global renewable energy production would have to increase by at least 90-fold. For context: it took a half-century for global oil and gas production to expand by 10-fold. It is a fantasy to think, costs aside, that any new form of energy infrastructure could now expand nine times more than that in under half the time.”

The Physics-Driven Cost Realities of Wind and Solar

“The high energy density of the physical chemistry of hydrocarbons is unique and well understood, as is the science underlying the low energy density inherent in surface sunlight, wind volumes, and velocity. Regardless of what governments dictate that utilities pay for that output, the quantity of energy produced is determined by how much sunlight or wind is available over any period of time and the physics of the conversion efficiencies of photovoltaic cells or wind turbines.”

The Hidden Costs of a “Green” Grid

“The issue with wind and solar power comes down to a simple point: their usefulness is impractical on a national scale as a major or primary fuel source for generating electricity. As with any technology, pushing the boundaries of practical utilization is possible but usually not sensible or cost-effective.”

Batteries Cannot Save the Grid or the Planet

“The $5 billion Tesla “Gigafactory” in Nevada is currently the world’s biggest battery manufacturing facility. Its total annual production could store three minutes’ worth of annual U.S. electricity demand. Thus, in order to fabricate a quantity of batteries to store two days’ worth of U.S. electricity demand would require 1,000 years of Gigafactory production.”

“China already dominates global battery manufacturing and is on track to supply nearly two-thirds of all production by 2020. The relevance for the new energy economy vision: 70% of China’s grid is fueled by coal today and will still be at 50% in 2040. This means that, over the life span of the batteries, there would be more carbon-dioxide emissions associated with manufacturing them than would be offset by using those batteries to, say, replace internal combustion engines.”

Moore’s Law Misapplied

“Logic engines don’t produce physical action but are designed to manipulate the idea of the numbers zero and one. Unlike engines that carry people, logic engines can use software to do things such as compress information through clever mathematics and thus reduce energy use. No comparable compression options exist in the world of humans and hardware.“

Sliding Down the Renewable Asymptote

“There are no subsidies and no engineering from Silicon Valley or elsewhere that can close the physics-centric gap in energy densities between batteries and oil. The energy stored per pound is the critical metric for vehicles and, especially, aircraft. The maximum potential energy contained in oil molecules is about 1,500% greater, pound for pound, than the maximum in lithium chemistry. That’s why the aircraft and rockets are powered by hydrocarbons. And that’s why a 20% improvement in oil propulsion (eminently feasible) is more valuable than a 200% improvement in batteries (still difficult).”

Digitalization Won’t Uberize the Energy Sector

“Every energy conversion in our universe entails built-in inefficiencies—converting heat to propulsion, carbohydrates to motion, photons to electrons, electrons to data, and so forth. All entail a certain energy cost, or waste, that can be reduced but never eliminated. But, in no small irony, history shows—as economists have often noted—that improvements in efficiency lead to increased, not decreased, energy consumption.”

Energy Revolutions Are Still Beyond the Horizon

“Hydrocarbons—oil, natural gas, and coal—are the world’s principal energy resource today and will continue to be so in the foreseeable future. Wind turbines, solar arrays, and batteries, meanwhile, constitute a small source of energy, and physics dictates that they will remain so. Meanwhile, there is simply no possibility that the world is undergoing—or can undergo—a near-term transition to a “new energy economy.”

Don’t agree? Read the piece in its entirety. The logic interlocks pretty firmly.

Le Carre as Literary

I’ve read each of his novels and never once doubted it. They’re literary.

And what a wonderful tribute this piece is:

John le Carre’s Novels Weren’t Just Spy Thrillers — They Were High Literature

Next, go read the works themselves

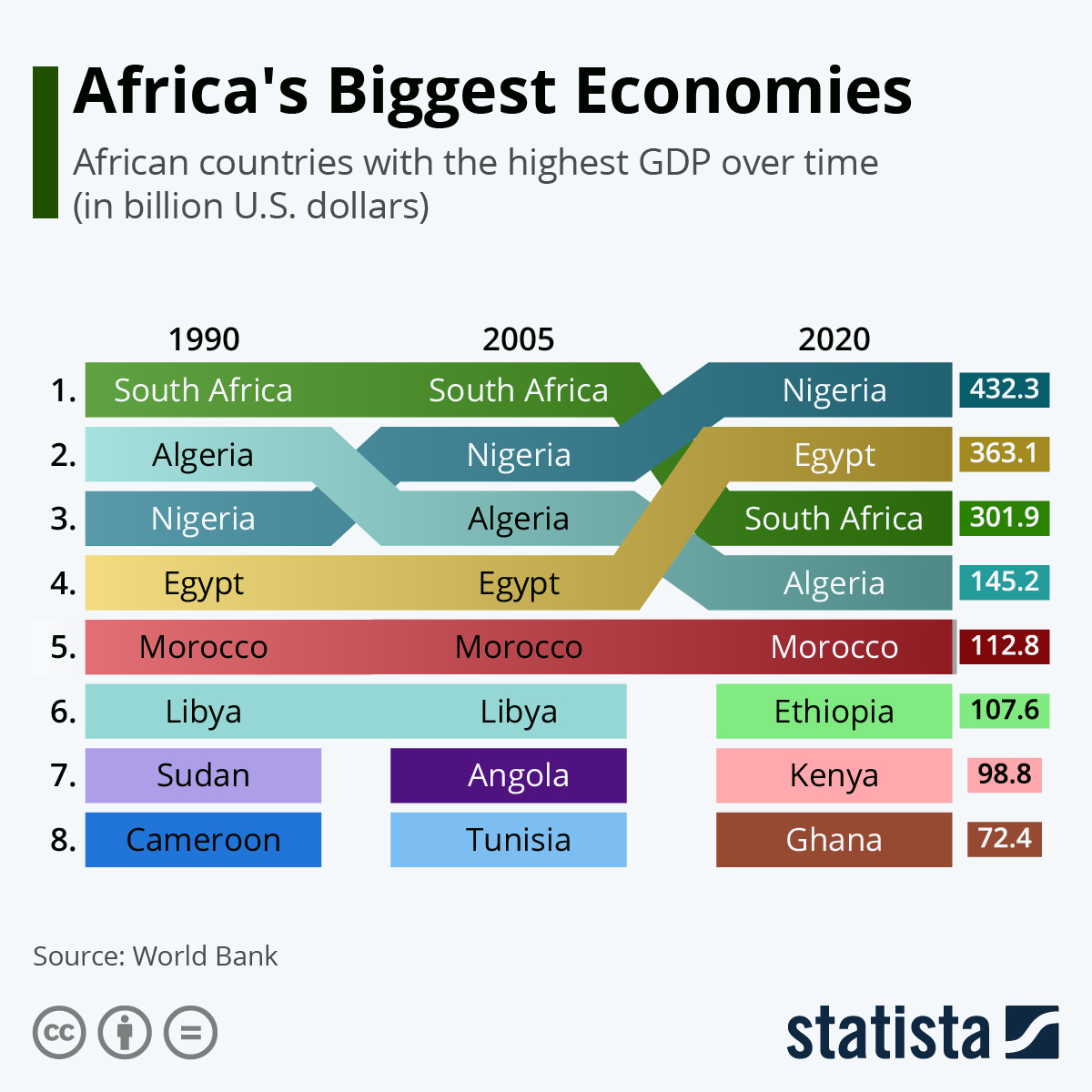

Key African GDP’s

South Africa’s reign is over.

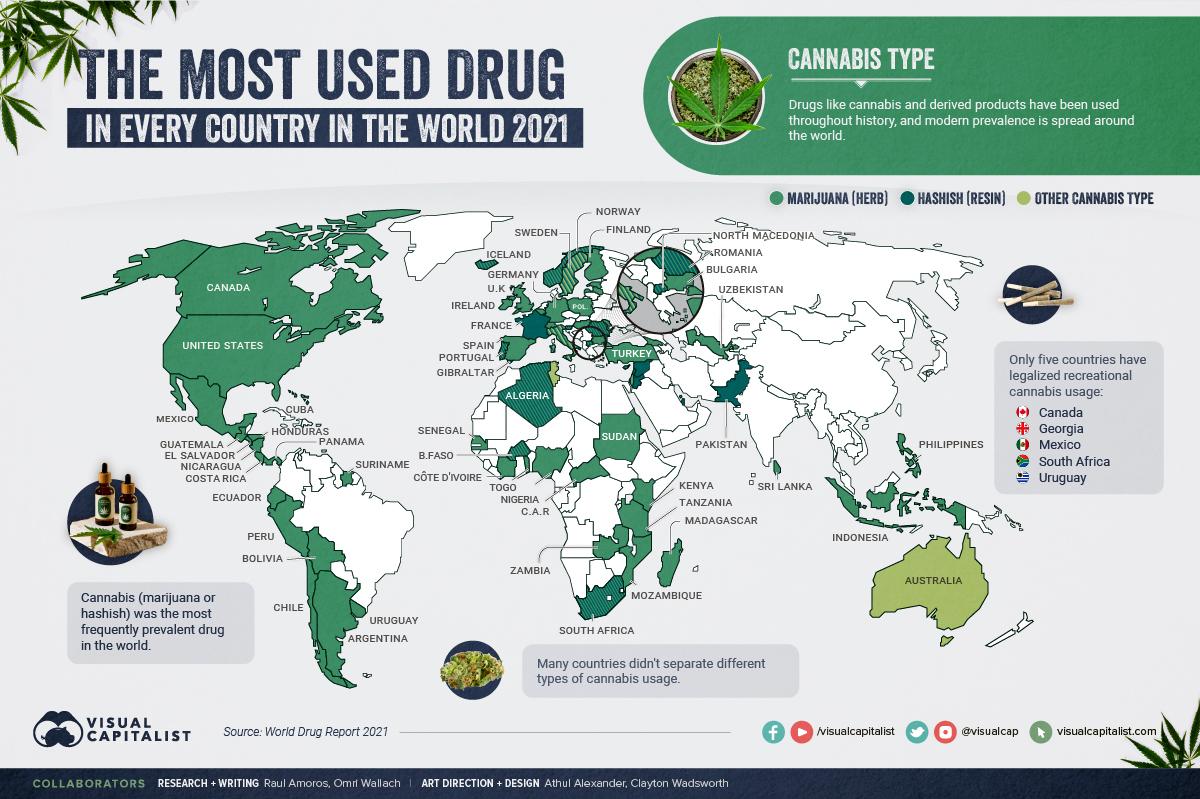

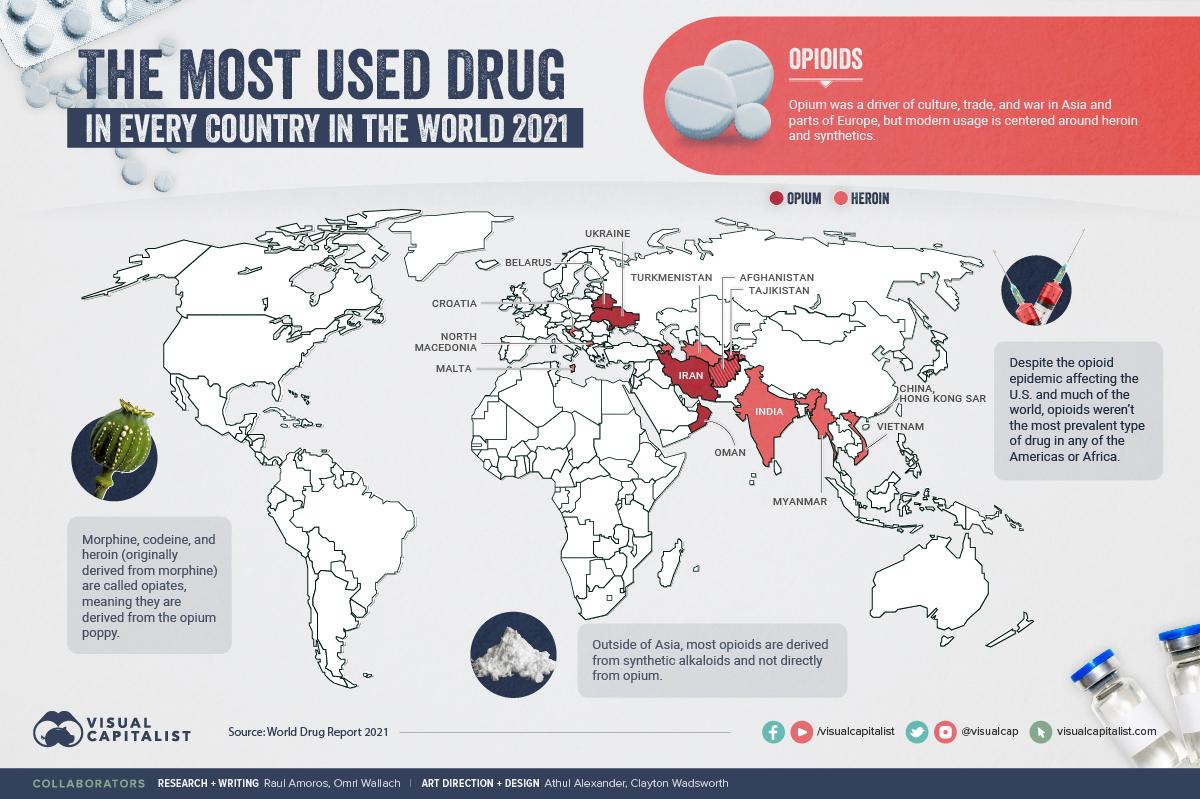

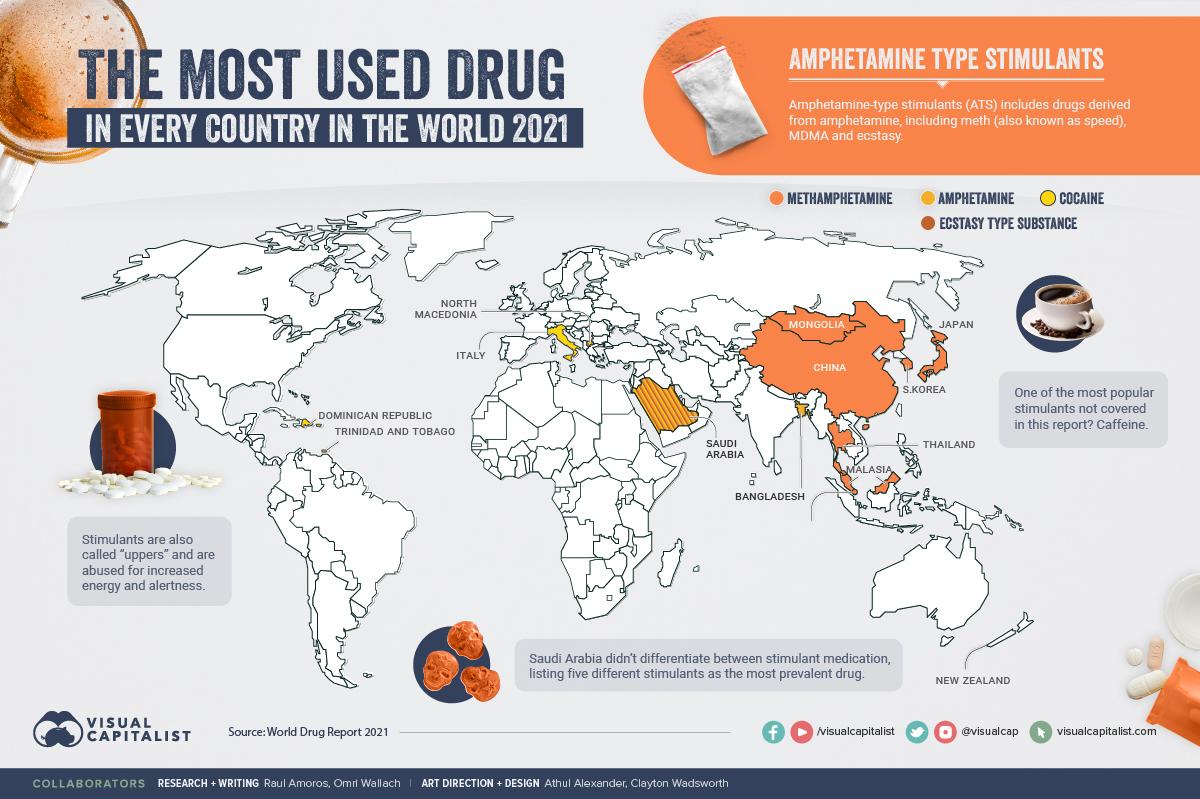

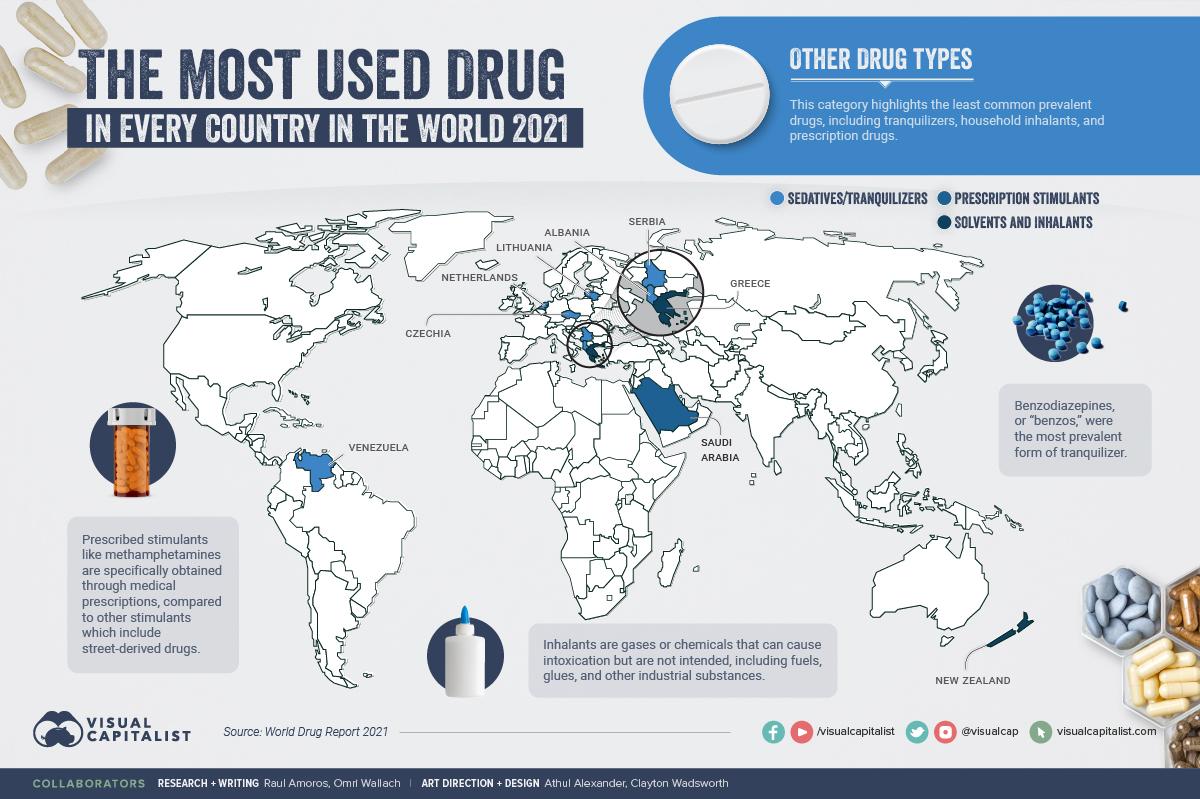

Most Common Illicit Drugs

To quote Hyman Roth or, if not him, SOMEONE in Godfather II — “we’re bigger than AT&T!

No doubt they were.

But so is THIS trade.

Money will OUT.

Me?

I ABSTAIN.